Setting the Stage

Recently, I was exploring the Argentinian equities landscape. But I did not get too far. The first company on my list, the leader of the ARGT ETF, was just excellent. This company is MercadoLibre. You can read up on its massive moats and more in this post by Capitalist Letters.

Below I provide further detail on the company and my investment take on it.

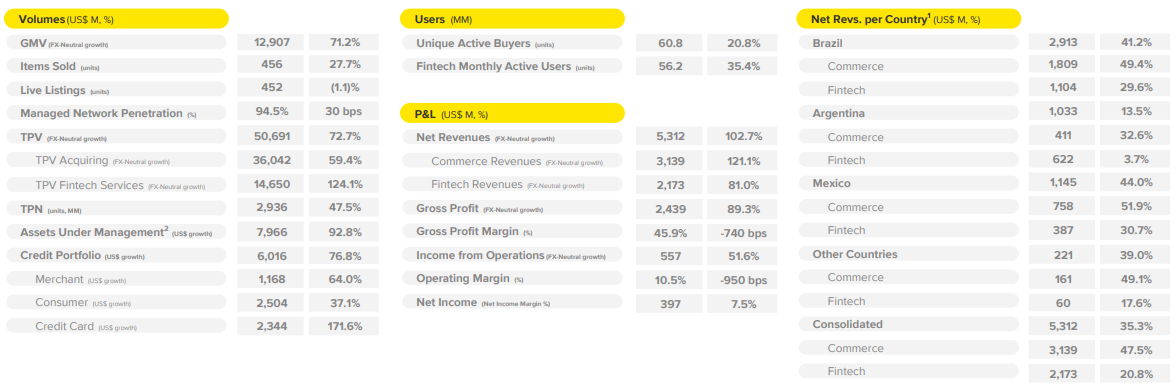

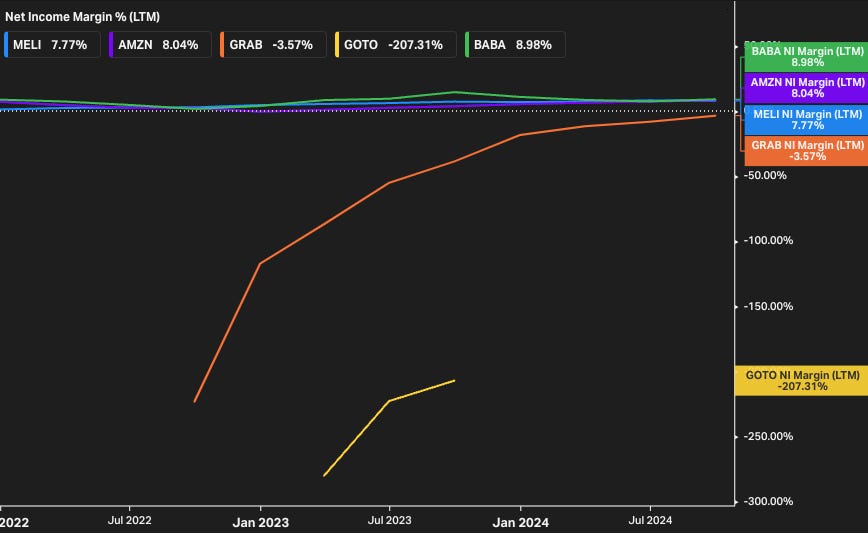

Quick Stats and Comps

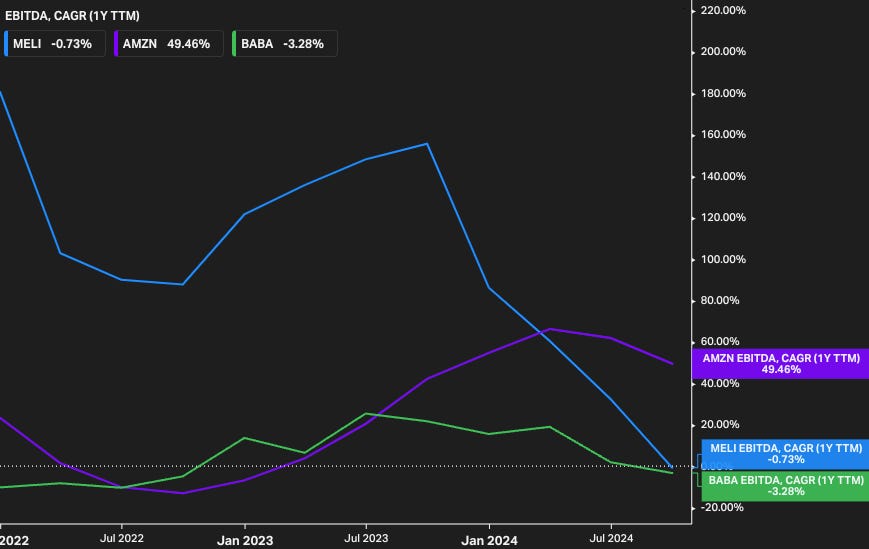

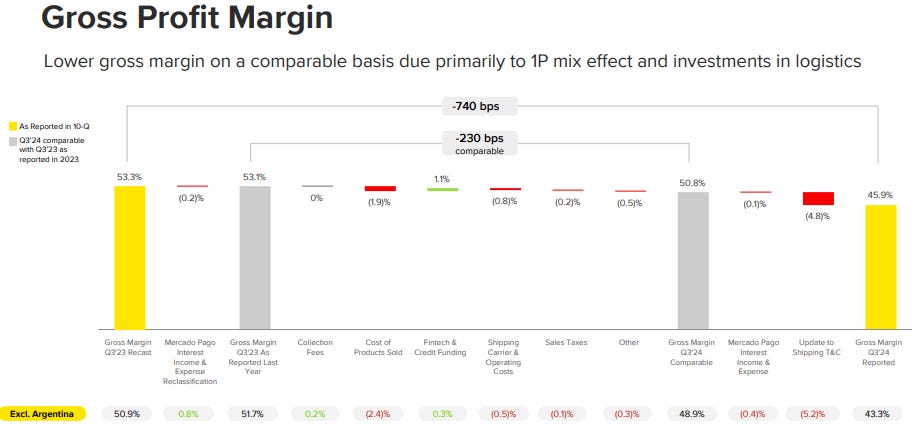

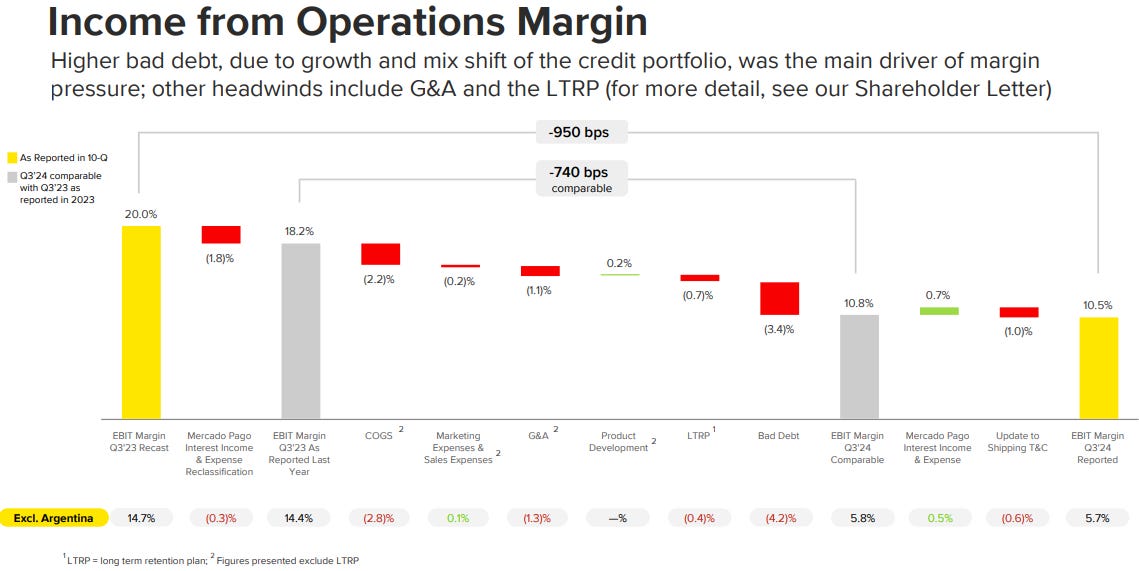

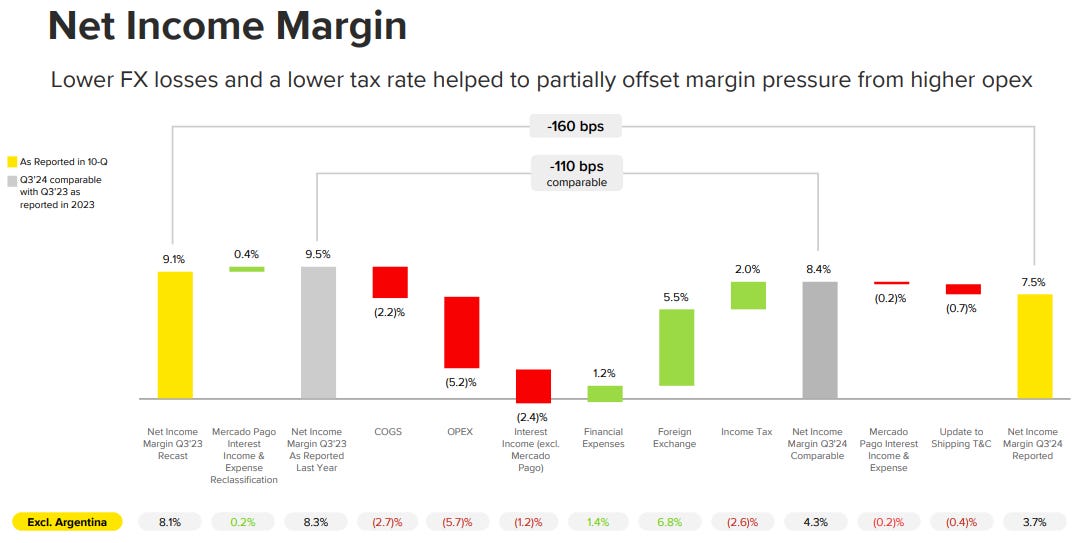

Regarding business performance, everything looks great, except for margin compression. Despite growth across the board, EBITDA stopped growing in the past year or so. The management explained this well.

COGS drove 2.2% margin compression, mainly due to a mix shift in the commerce business.

OPEX drove 5.2% margin compression, driven mostly by investment in MELI’s credit business, where they significantly grew origination, which in turn grew provisions for losses (as MELI accounts for these upfront). Secondly, there was some effect of inefficiencies in their shipping as they scale out their logistics network. Beyond that, there were multiple accounting effects. In summary, the margin compressed due to investment in growth, which is a good reason.

Note that foreign exchange plays quite a large role for MELI, so while in the last quarter it helped, it may hurt in the future.

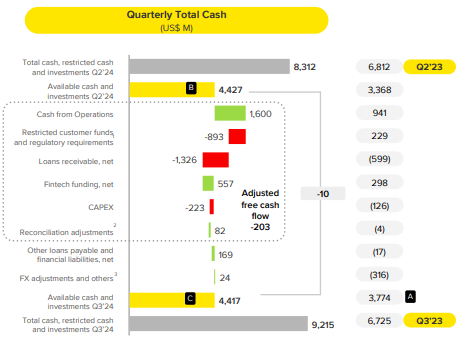

While Cash from Operations was $1,600MM, that needs to be adjusted for restricted customer funds and bad debt, rendering Cash From Operations an unusable metric until the company slows its growth.

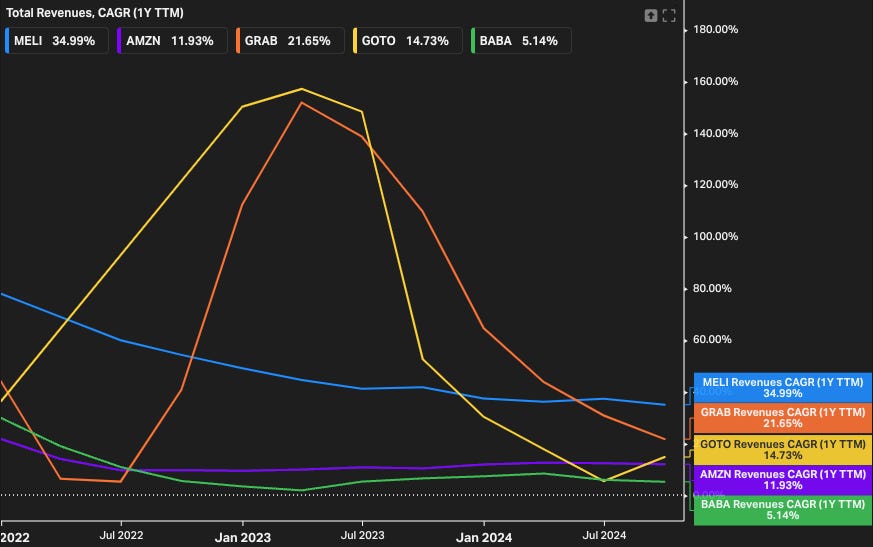

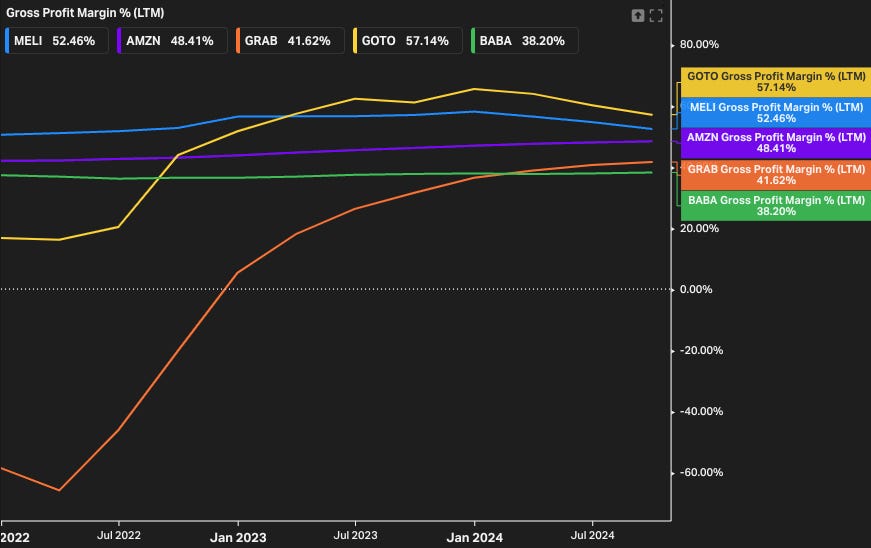

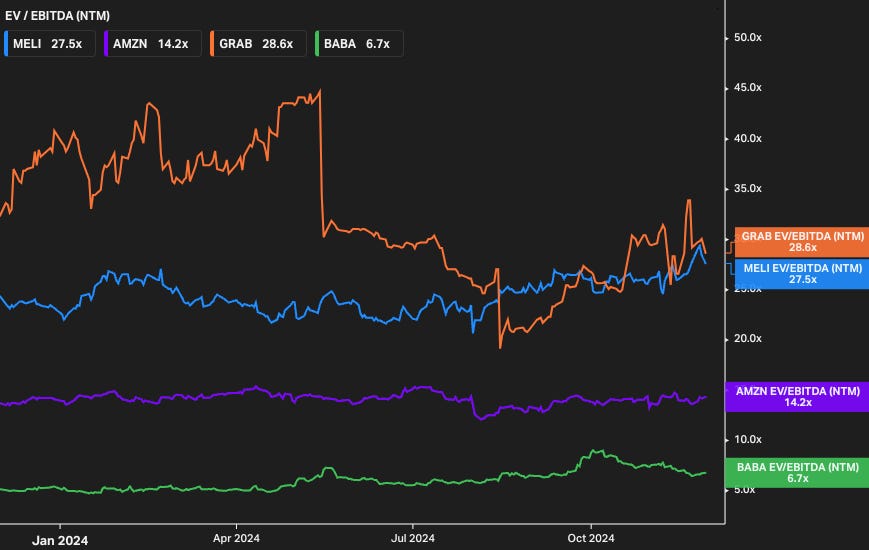

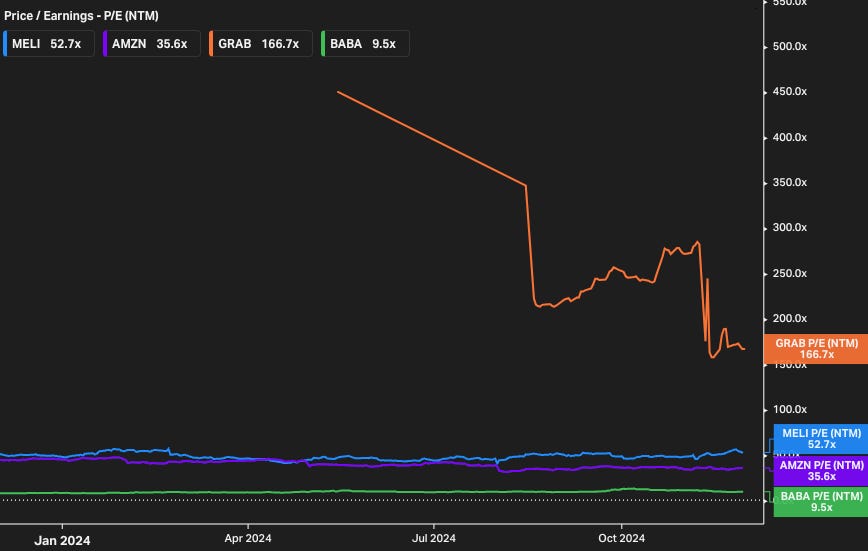

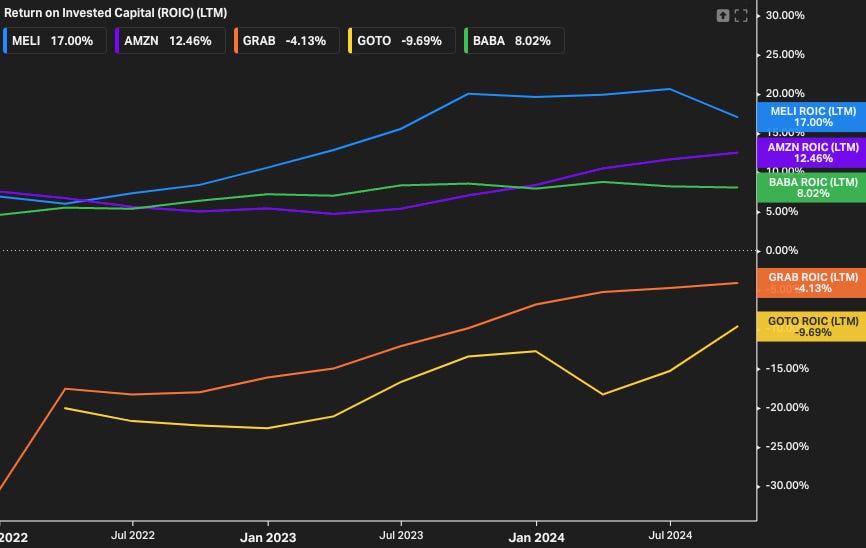

Valuation is about double that of Amazon. However, MELI’s top line grows 3x as fast as Amazon’s, it is earlier in its growth story, and it probably has a longer TAM runway. Margins are very comparable for the two companies.

Ownership: No key shareholder. Druckenmiller recently increased his exposure to MELI to 3.3% of his portfolio.

Capital Allocation: MELI does not pay dividends and it buys back shares only sporadically (buybacks are in excess of stock-based compensation). It has been issuing net debt ($1.3B LTM). In summary, it retains its earnings and utilizes its debt capacity to fund growth. With low debt (0.69x Net Debt / EBITDA) and excellent growth opportunities, this is the right thing to do.

My Take

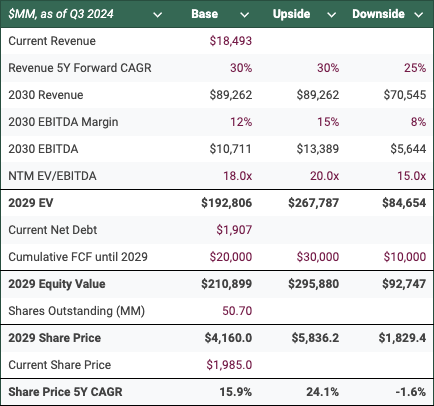

I see the current valuation as appealing. I am not that concerned about MELI’s growth prospects. Given the recent crosswinds from margin contraction, one-offs, and changing portfolio mix, I am less sure about where the sustainable level of MELI’s EBITDA margin will settle. Along with currency and regional risks (taxes, regulation, inflation, etc.), this is the key risk I see at the moment.

Positions

Long MELI stock, 2.5% of my portfolio, cost basis of 1,937.95.

Depending on future developments, I plan to double the position.

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.