Setting the Stage

There are no low-energy rich countries. This statement will grow even more relevant with the enormous electricity demands that will stem from AI-compute buildout. One starts to wonder how we, as a civilization, can meet this immense electricity demand. I came to the conclusion that trying to do so without nuclear energy is like bringing a knife to a gunfight.

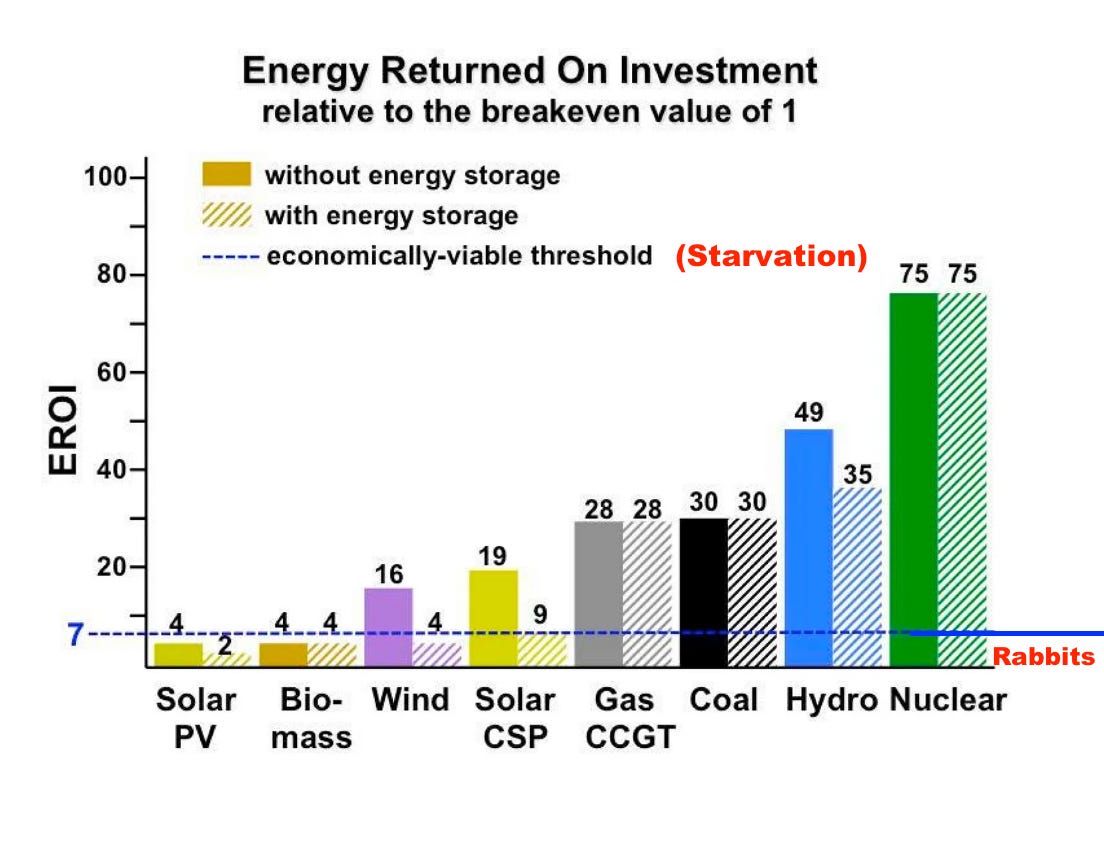

The appeal of nuclear energy lies in its efficiency. The EROI of nuclear energy is 75, double that of gas or coal power. To paint the picture, compare the material intensity of nuclear to coal. A modern coal plant requires 14-47x more mined material than a comparable nuclear plant (depending on coal quality). Not only is it efficient in terms of energy and material intensity, but it is efficient also in terms of emissions (~10 gCO2eq/MJ, compared to coal with >800 gCO2eq/MJ).

Yes, nuclear has its issues. Cost to build and the risk of cost overruns are significant. Secondly, once operational, there is always the risk of a meltdown. But I believe these issues can be overcome with scale, standardization, and smart engineering. Chinese are showing us that costs and overrun risks can be cut significantly when one does not build one-off bespoke power plants. The meltdown risk pertains mainly to older designs and will be diminished further with each new generation of nuclear power. I am optimistic about the future of nuclear power and uranium demand. So how does one invest in it?

Nuclear is the real solution, while coal continues to be the quick-fix.

Table of Contents

Nuclear Fuel Supply Chain

Supply and Demand

Demand

Supply

Balance

Inventory

Procurement and Contracting

Current Dynamics

Prices

Investment Landscape

Thesis and Risks

Positions

1. Nuclear Fuel Supply Chain

The primary energy source of nuclear fuel is uranium.

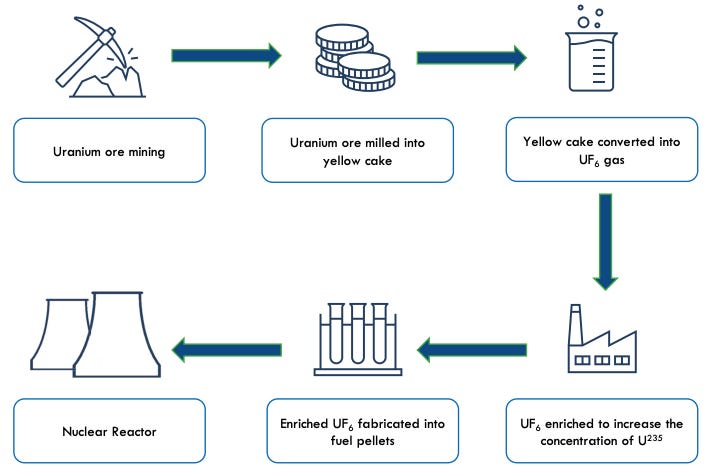

Uranium goes through 5 stages before it is used in a nuclear reactor.

Uranium ore mining is a difficult task, matched only by the difficulty of opening a new uranium mine. The three mining methods are open pit mining, underground mining, and in-situ recovery (ISR). ISR is an increasingly common method. High grade is above 1% of uranium content, medium grade is 0.1-1%, and low grade is below 0.1%. Acid leaching, typically utilizing sulphuric acid, is used to dissolve and extract uranium from ore. Reliable access to acid for leaching has been a bottleneck for the largest uranium miner in the world, Kazatomprom.

Once uranium is dissolved into the acid solution, it is purified, concentrated, and dried into a yellow-brown powder (“yellowcake”). Yellowcake contains around 80% uranium oxide (U3O8). U3O8 is the uranium product that is traded, both on spot and term markets (more on this below). U3O8 price is quoted in $/lb.

U3O8 is not directly usable as a fuel and needs to be processed further as it contains only 0.7% of uranium-235 (the part that can undergo fission, i.e. create energy); the remainder is uranium-238 (not fissile). For most commercial reactors the concentration of U-235 needs to be increased to around 3.5%-5.0% (as compared to weapons application, where it needs to be at ~90%). This is done through conversion and enrichment processes.

Conversion: The uranium oxide (U3O8) is first refined to uranium dioxide (UO2), which can be used as fuel for those types of reactors that do not require enriched uranium. The balance – most of the uranium oxide – is then converted into uranium hexafluoride (UF6), which is a gas at relatively low temperatures. The uranium hexafluoride is then drained into 14-tonne cylinders. These metal containers are shipped to the enrichment plant. The conversion price is quoted in $/kgU.

Enrichment: The enrichment process separates uranium hexafluoride into two streams: one being enriched to the required level and known as low-enriched uranium (LEU); the other stream is progressively depleted in U-235 and is called tails, or depleted uranium. The main enrichment process in commercial plants uses centrifuges, with thousands of rapidly spinning vertical tubes. The product of this stage of the nuclear fuel cycle is enriched uranium hexafluoride, which is reconverted to produce enriched uranium oxide. So the outcome of this process is enriched uranium product (EUP). The enrichment price is quoted in $/SWU (separative work unit, which is a measure of enrichment services proportional to the energy and time required).

Once the uranium is enriched, the last step is the fabrication of reactor fuel. Reactor fuel is generally in the form of ceramic pellets. These are formed from pressed EUP, which is baked at a high temperature (over 1400°C). The pellets are then encased in metal tubes to form fuel rods, which are arranged into a fuel assembly ready for introduction into a reactor.

This whole process takes 18-24 months to complete.

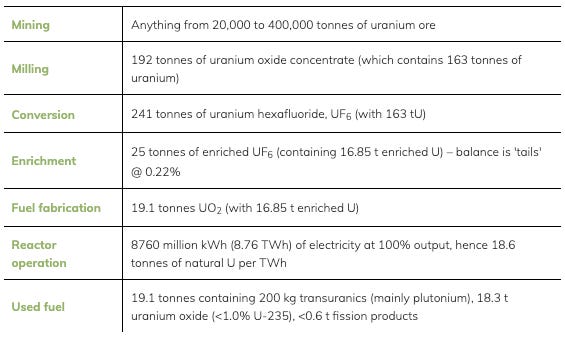

For context, below is a material balance in the nuclear fuel cycle for one year of operation of a modern 1000MWe nuclear reactor utilizing 5% enriched fuel and a higher fuel burn-up (65 GWd/t).

This means that a 1000MWe nuclear power plant requires annual mining of 180,000 tonnes of uranium ore on average. Compare that to a comparable 1000MWe coal plant, which requires annual mining of 2.6 million tonnes (14x more than uranium) of bituminous coal, or 8.5 million tonnes (47x more than uranium) of lignite.

2. Supply and Demand

Demand

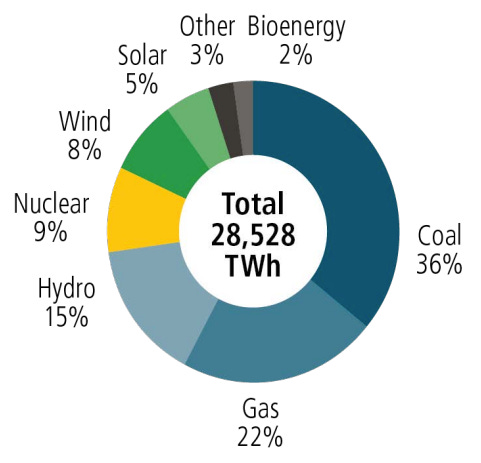

There are 439 operable reactors (396,312 MWe capacity) and 66 under construction (additional 67,340 MWe capacity). 30 of those 66 reactors under construction are in China and 0 in the US. More data here. Nuclear power represented a 9% share of global electricity generation in 2023 (2,602 TWh out of 28,582 TWh total).

In the US alone, the 2022 actual electricity consumption was 126 TWh. Without the impact of AI compute buildout, that would have grown 2.5x to 230 TWh by 2030. With the AI impact, US electricity consumption will more than 3x by 2030 to 335-390 TWh (BCG).

High-level breakdown of uranium (U3O8) consumption is:

439 reactors x average consumption 400k lbs/yr = 175 Mlbs/yr

Global naval demand: 10-15 Mlbs/yr

Inventory restocking and other: 10 Mlbs/yr

Total global consumption is currently around 200 Mlbs/yr.

The forecast for 2030 is a total global consumption of around 250 Mlbs/yr.

Note that newly built nuclear plants are required to stockpile several years of fuel for startup.

Supply

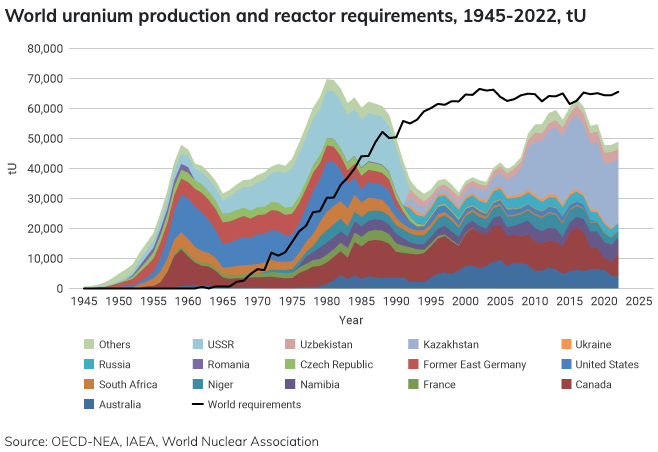

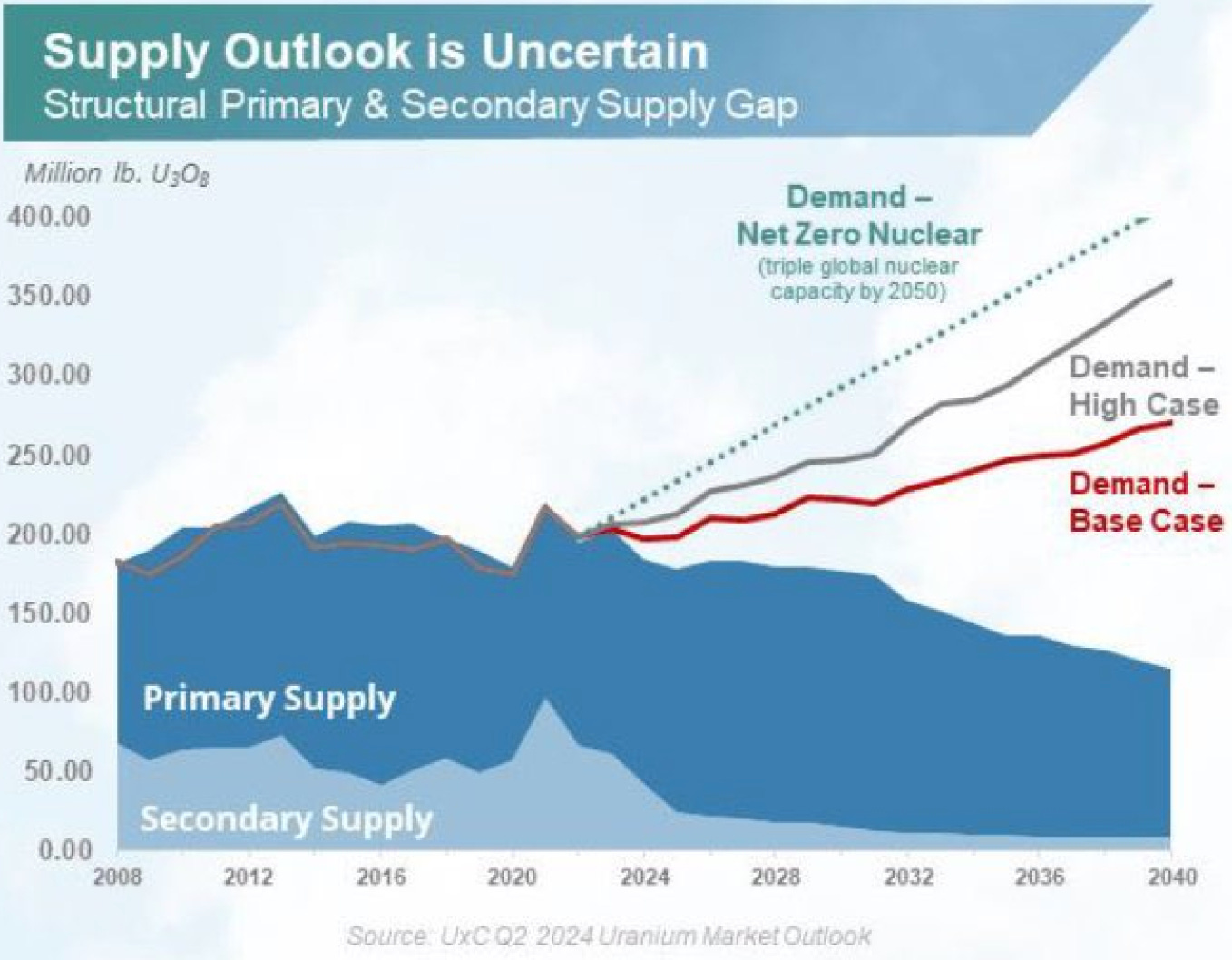

Following the WW2, uranium production was surging until the 1990s. Since the early 1990s, supply has been well below demand. The balance was made up of secondary sources, including downblending highly enriched uranium (HEU) from dismantled nuclear weapons and depleting government and utility stockpiles. At present, stockpiles (outside of China) are not exactly overflowing and the downblending of HEU is steadily declining as a secondary source of supply.

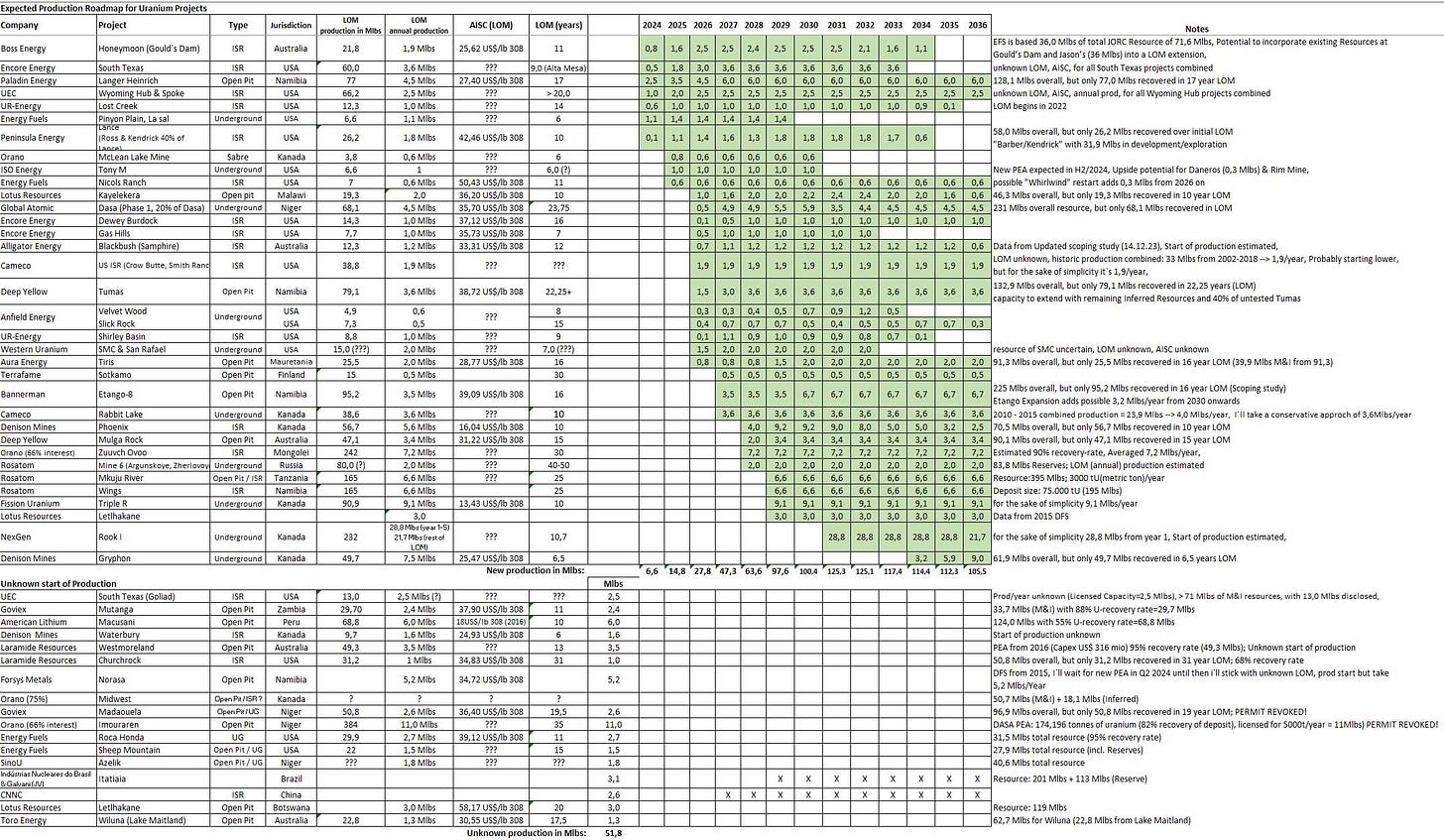

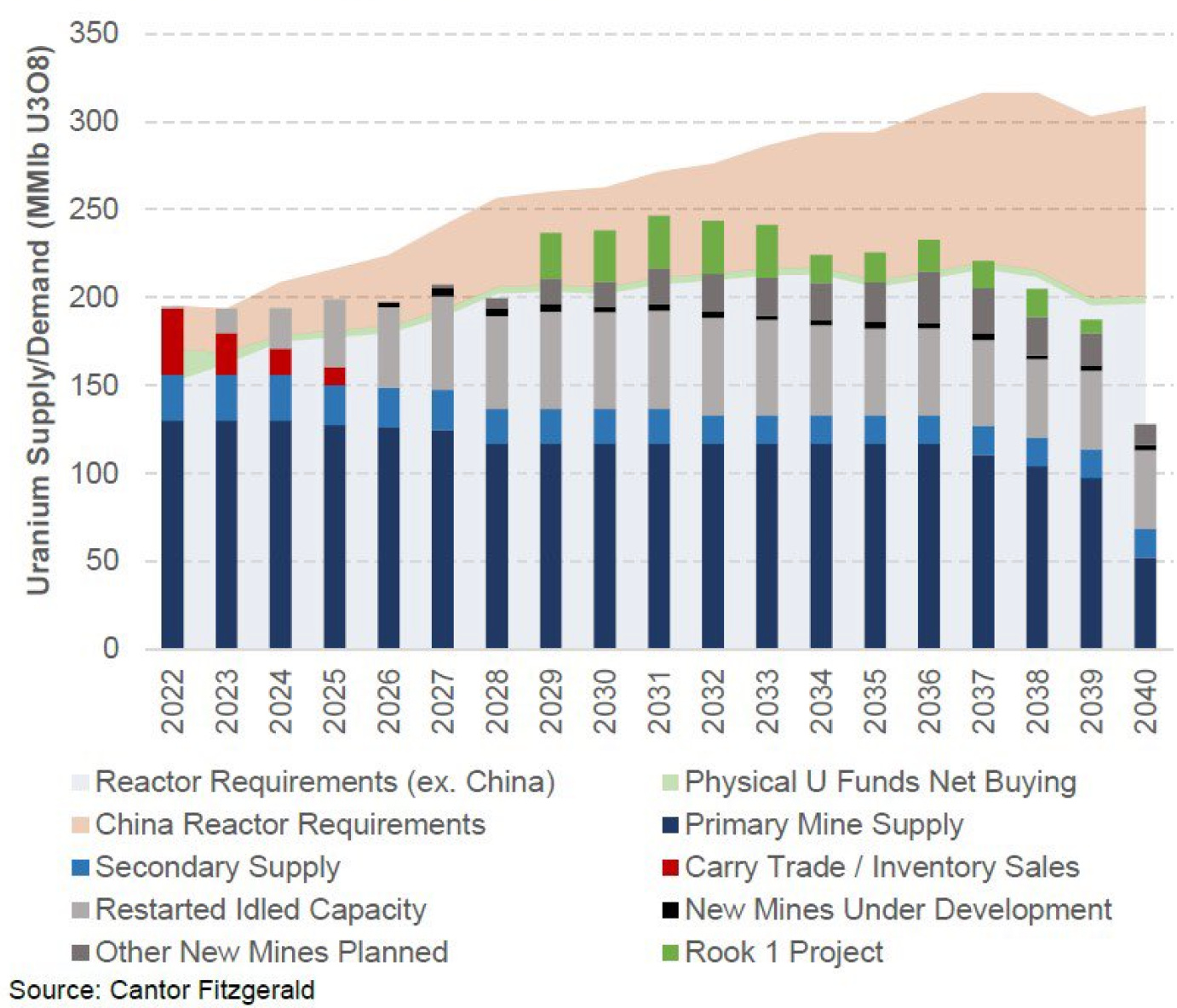

Depending on the source, the current U3O8 primary mine supply is some 130-145 Mlbs/yr. The market is obviously aware of this deficit and companies are working on restarting idled capacity and building out new capacity. If everything goes according to plan (which it won’t), the new primary supply is set to add another 100 Mlbs/yr supply by 2030 for a total of 230-245 Mlbs/yr, which would still be short of the projected demand of 250 Mlbs/yr.

Some other figures include:

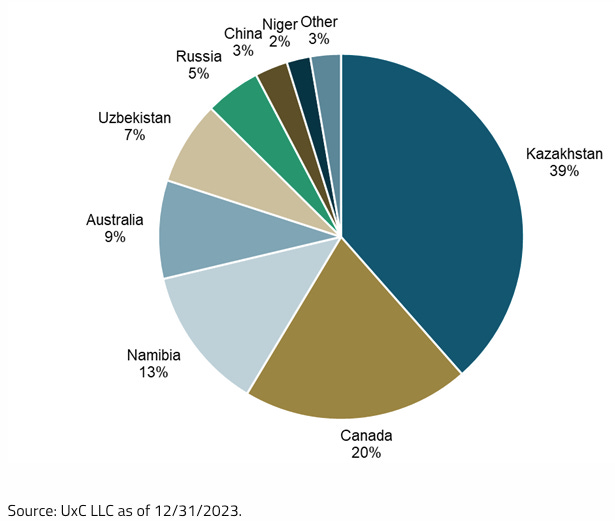

World uranium production by location:

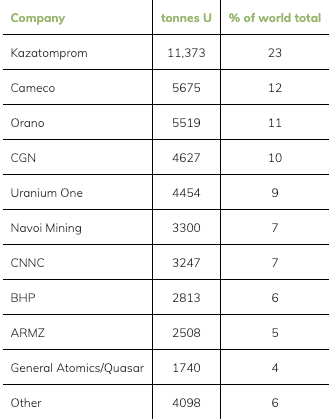

World uranium production by company (2022):

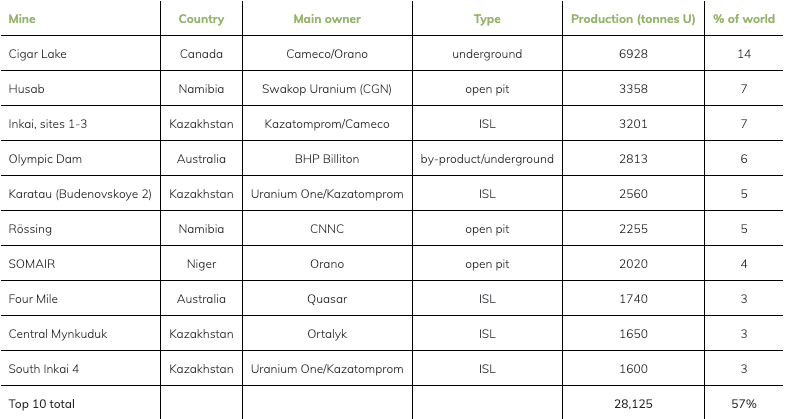

The largest-producting uranium mines (2022):

World uranium resources and reserves by location:

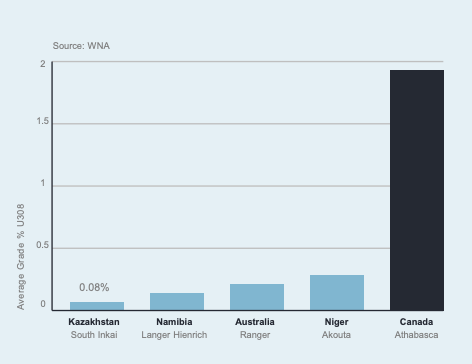

Average grade by location:

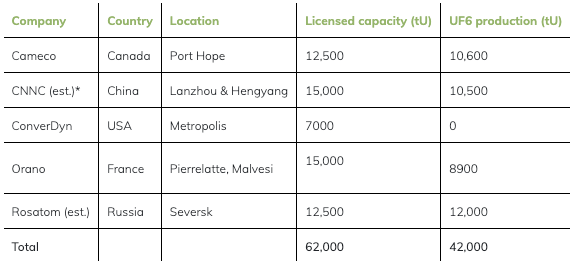

World conversion capacity(2022):

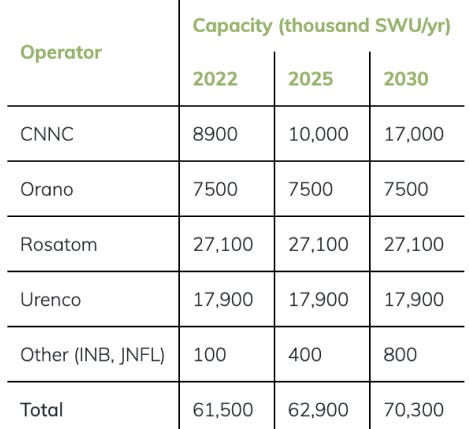

World enrichment capacity (2022):

Balance

To put it all together, primary supply will be insufficient to meet demand and the market continues to rely on secondary sources. The direction of travel is a persistent deficit.

In simple terms, by 2030, 25% of the pounds that will be needed are not even approved yet. 5-10% are under development and things can go wrong.

Inventory

The key input into the equation is how much inventory is there. While there are no exact figures, UxC and Trade Tech have declared The Era of Inventory Overhang to be over.

While China is building a strategic national reserve, which was estimated at 350 Mlbs U3O8 at the end of 2022, the market views this as an inaccessible reserve. China has no incentive to sell these pounds, rather they want to keep increasing their stockpiles as they ramp up their nuclear power buildout.

3. Procurement and Contracting

Interestingly, utilities typically don’t buy final fuel assemblies outright. Instead, they typically buy uranium oxide (U3O8) and contract conversion, enrichment, and fuel fabrication services separately as needed. This gives them better price transparency and other benefits. From a logistics point of view, utilities use a “book transfer” mechanism, where only the final fuel assembly arrives at the respective powerplants, and U3O8 and the intermediate products are stored at/close to the facilities where they are produced/needed.

U3O8 is traded in spot and term markets. The spot market is thinly-traded where utilities pick up small, discretionary volumes. Besides utilities, physical uranium funds, such as Sprott Physical Uranium Trust, are also buyers of spot uranium. The term market is where utilities contract supply for 3-15 years ahead. Some producers, such as Cameco, sell the majority (often more than 100%) of their production on a term basis, while other producers (usually junior miners) keep more exposure to the spot market.

Pricing in long term contracts is either fixed (escalated by inflation) or market-related (price linked to a price index, such as the spot price, with ceilings and floors). Utilities tend to prefer fixed-price contracts, while miners tend to prefer market-related pricing.

Current Dynamics

Thus far in 2024, utilities have only contracted ~90 Mlbs of U3O8 (by October), well below the rate to achieve replacement rate contracting. The reason is not clear. It may be that utilities are waiting for a reversal on the recent uranium export ban by Russia (which would push global prices down). It may be that utilities are simply complacent and feel that they have time to wait and see if prices drop.

4. Prices

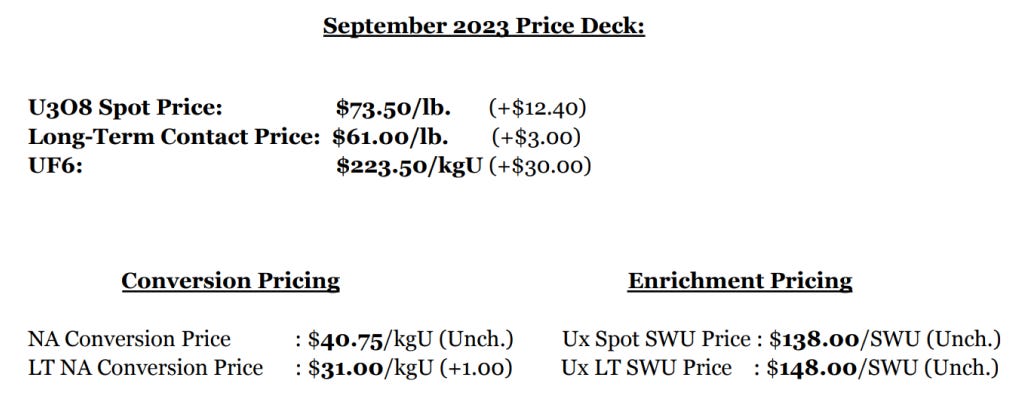

As indicated above, there are several relevant prices. See below for an illustrative snapshot of all the prices as of September 2023:

When observing the prices in the uranium supply chain, one needs to keep in mind that this is a very opaque, bilateral, low liquidity market, where not everything is reported.

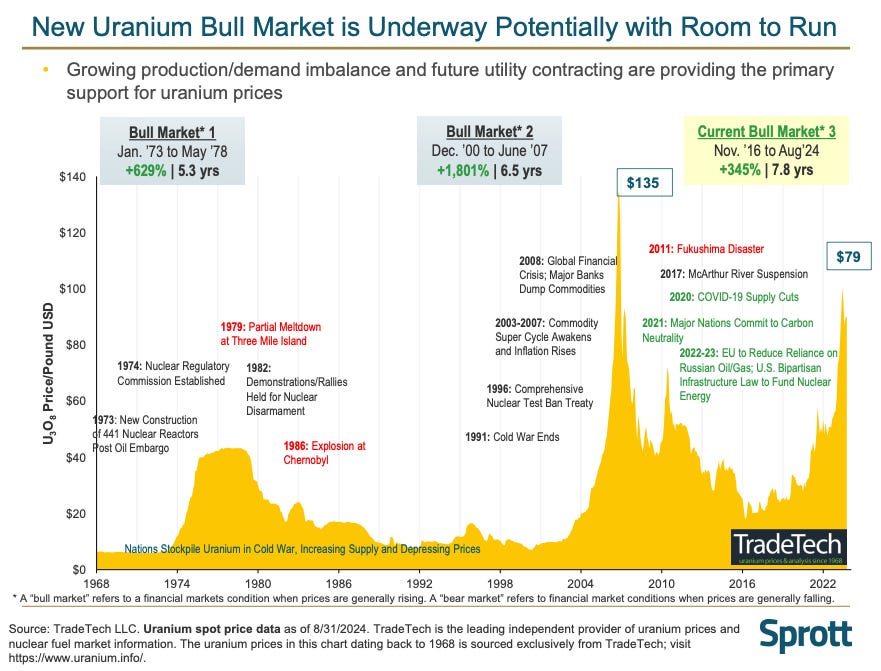

The chart below shows the historical development of U3O8 spot prices with narration around key price events.

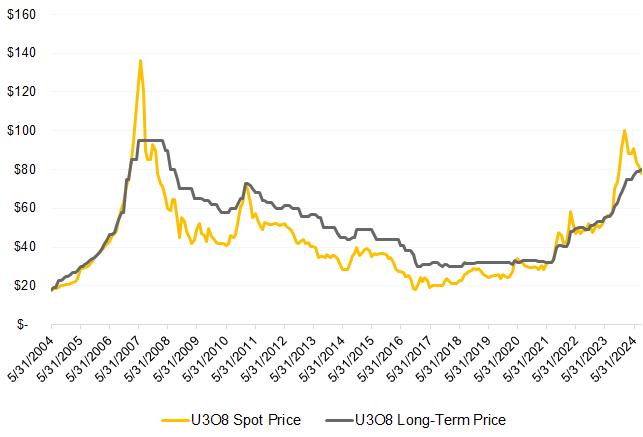

This chart shows the historical development of the U3O8 spot price compared to the term price.

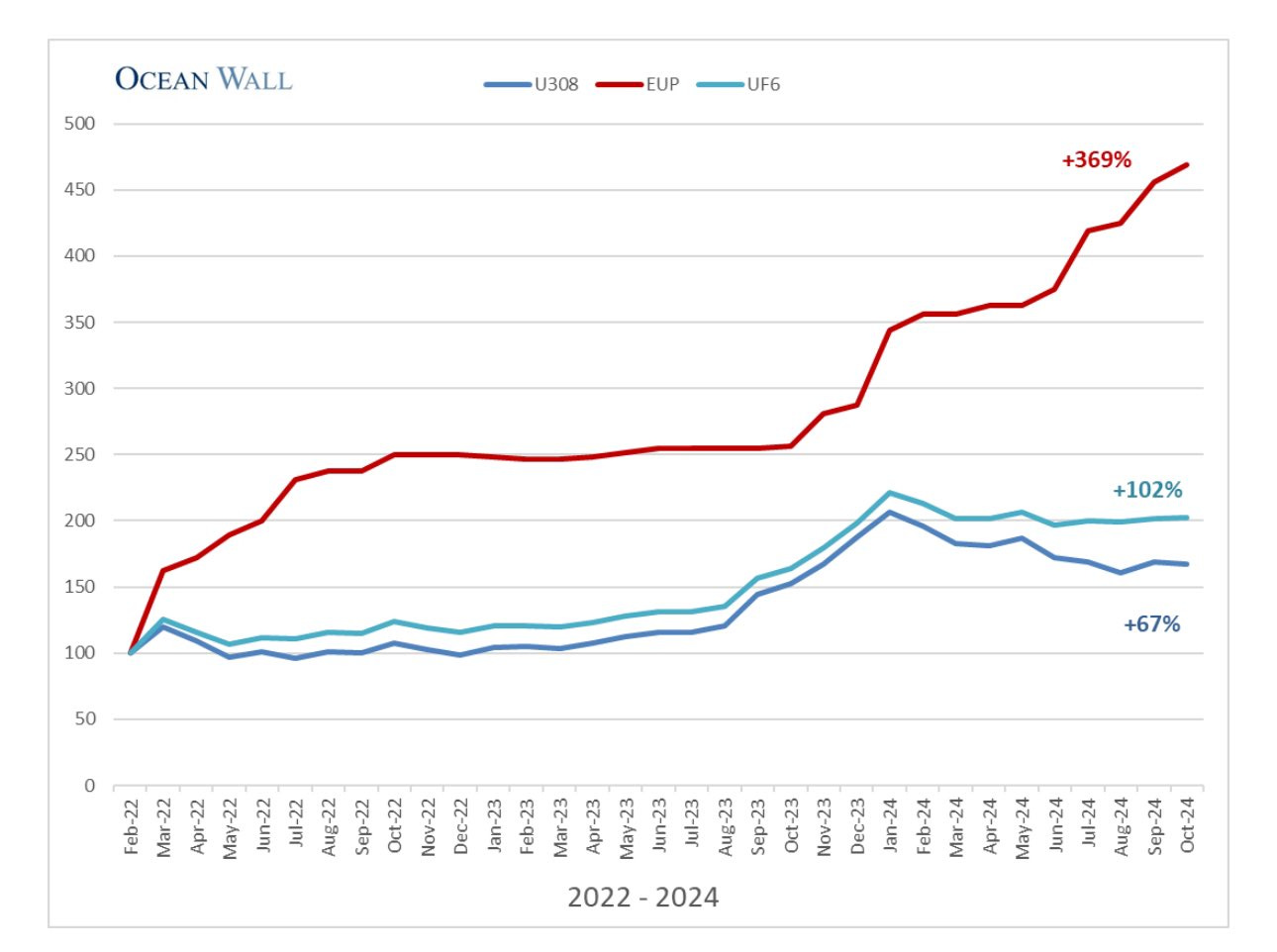

This chart shows recent price dynamics in uranium oxide (U3O8), conversion services (UF6), and enrichment services (EUP). It reflects the previously described procurement and contracting dynamics. Sooner or later, the structural deficit in UF6 and U3O8 will be exposed and the prices will likely catch up down the fuel supply chain.

5. Investment Landscape

The blue-chip instruments are:

URA - broad-based uranium/nuclear thematic ETF

SPUT - physical uranium fund

URNM - uranium miners ETF

URNJ - junior uranium miners ETF

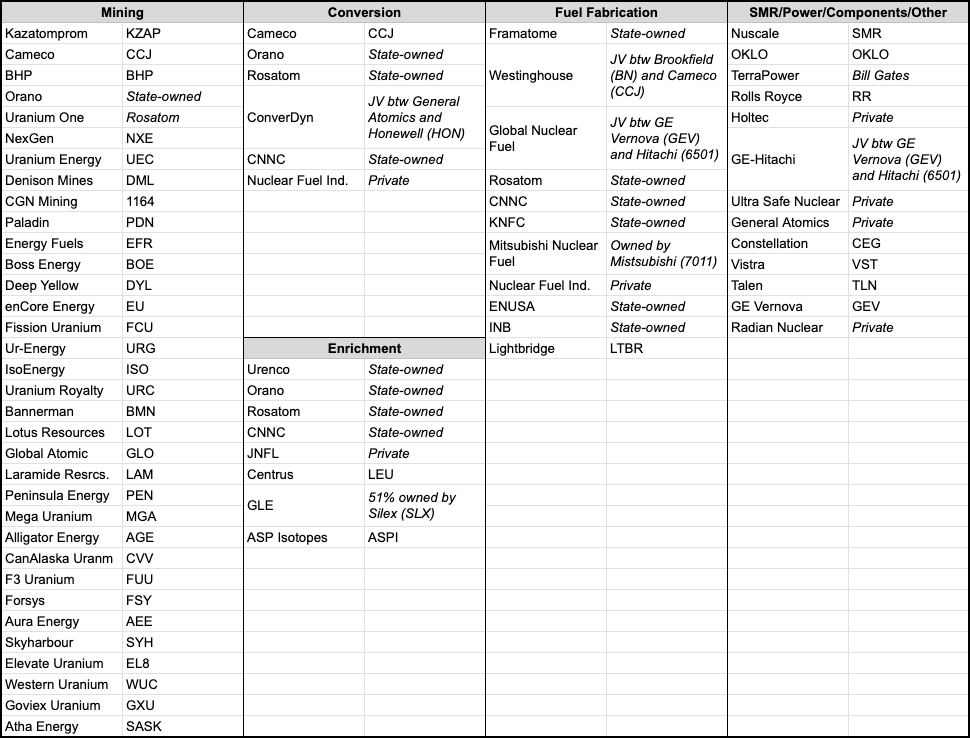

Below is an overview of the key players throughout the supply chain (non-exhaustive).

6. Thesis and Risks

With uranium inventories and secondary supplies now largely exhausted, and the market remaining in deficit, a surge in U3O8 prices isn't just possible – it's like waiting for the other shoe to drop.

The key question is when the shoe will drop and how loud it will hit the floor. No one knows, but my bet is that it will be next year. In the meantime, since Russia banned exports to the West, the supply deficit will be exacerbated due to the need for enrichment over-feeding.

Equities and spot U3O8 have already priced some of this dynamic, but a lot remains on the table. I see this as a good place from a risk/reward perspective.

Risks associated with the thesis are:

A nuclear meltdown

Broad-based economy slowdown

Russian ban gets lifted (the most likely risk in my opinion, but the impact should be only temporary as it won’t solve the structural supply deficit per se)

Chinese will start selling their inventory

7. Positions

Around 6% of my portfolio is currently allocated to uranium, with 50% allocated to URA and 50% to SPUT (U.UN).

Over the next couple of months I will increase my exposure to 10% of my portfolio, split into:

50% URA

40% SPUT (U.UN)

10% high-risk plays

I want to have a couple of high-risk high-reward plays. In my simple layman’s math, the more existing mines there are in an area and the higher the grade of the surrounding deposits the higher the chance that a new mine will get up and running, with low operating costs. I don’t want jurisdiction risk, so I am not going to invest in Kazakhstan, Niger, or similar. I want to have positions where well-versed investors have invested, and where I heard that the management is competent.

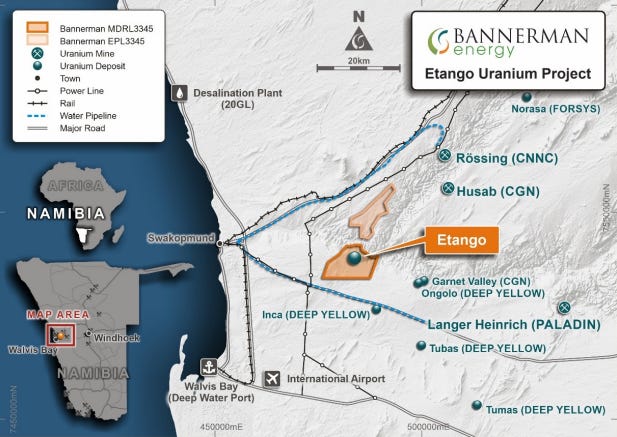

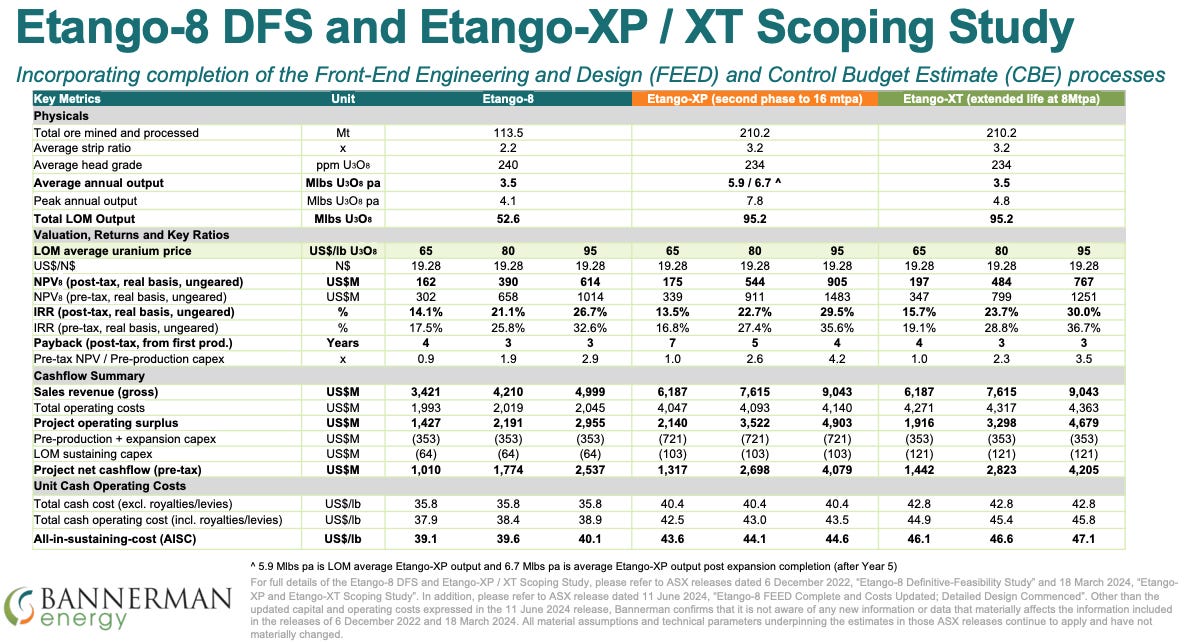

BMN - Exposure to Namibia, 225 Mlbs resources (first phase only), 52.6 Mlbs total LOM output (first phase only), 0.024% U3O8 grade, $40/lb AISC, $15.5MM cash, $315MM market cap, $1.4/lb of resources, $6/lb of output.

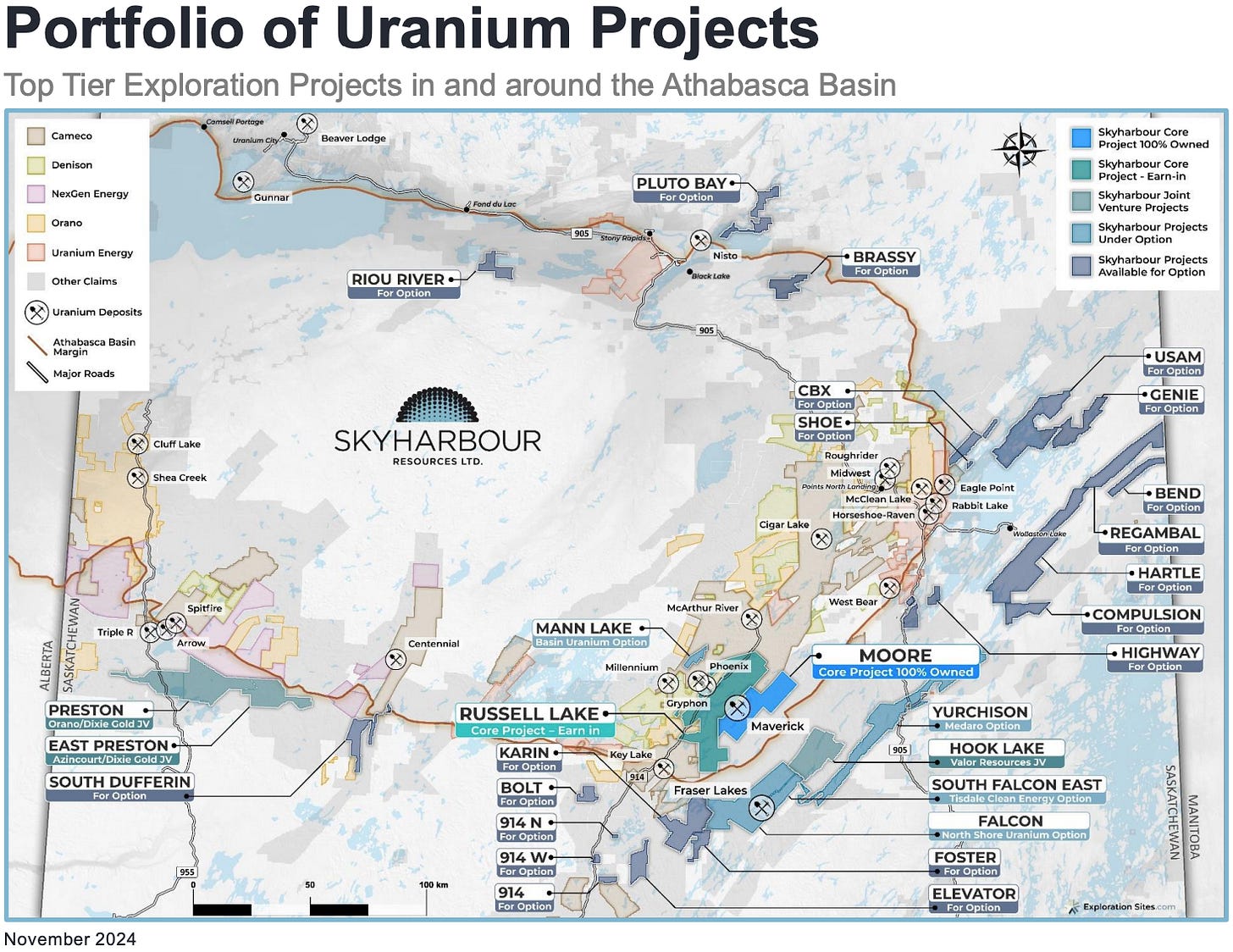

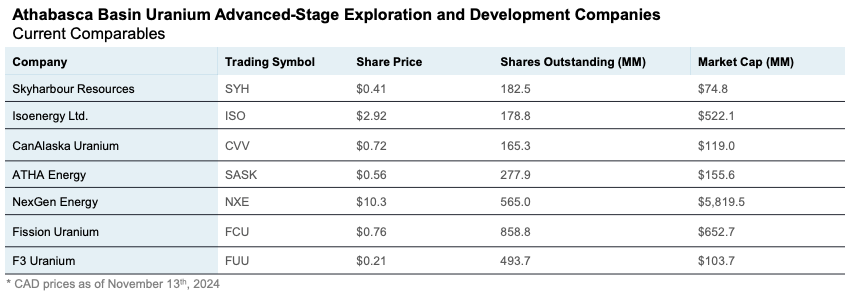

SYH - Exposure to the Athabasca basin through the smallest exploration company there. U3O8 grade from their exploratory drills reached up to 20%, 580,000 hectares of mineral claims, $3.8MM cash, $54MM market cap.

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.

We have more than 150 years of coal and 450 years of petroleum. Preparing for the natural convergence of time, technology and technique will provide far more efficient and economic alternatives than the overpriced products of today; most of which, the guilt driven public can't afford. Finally, independent authors, like Bjorn Lonborg, are coming forward to emphasize this inevitability.