Macro: Last week we received speeches from several Fed governors. Despite their relative hawkishness, the market-implied odds of a December cut rose to 86%. I believe this reflects accurately the present situation, where the Fed will try to sound hawkish, but will act dowish as they want to avoid economic weakening above all else.

NFP came in around estimate and the unemployment rate increased slightly to 4.2%. Next week we will get CPI on Wednesday and unemployment claims on Thursday.

Black Friday retail data were good, showing strong traffic, growing same-store sales, and limited promotional activity.

While everything looks like a perfect soft landing, we witnessed the first major red flag this week. David Rosenberg, known for his persistent bearish outlook on the economy, semi-capitulated this week, checking the box for one of the “prerequisites” of a recession.

Equities: SPX rose 0.89%, NDX 3.33%, and RTY declined 1.17% last week. The only sector outperforming NDX was consumer discretionary, which was up by 4.72%.

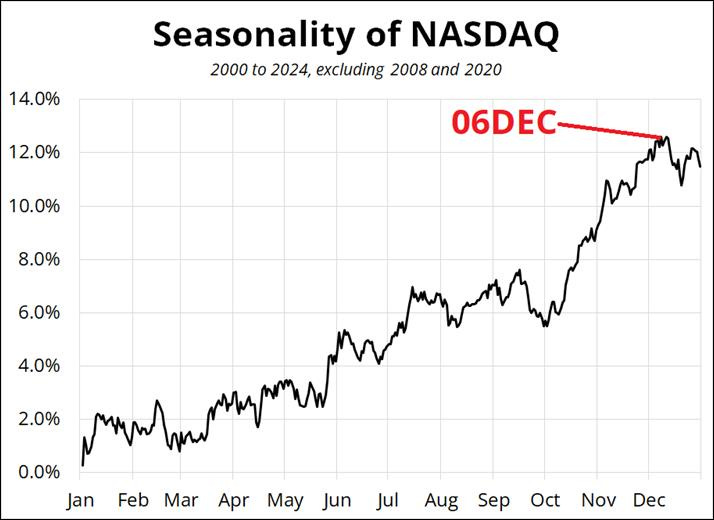

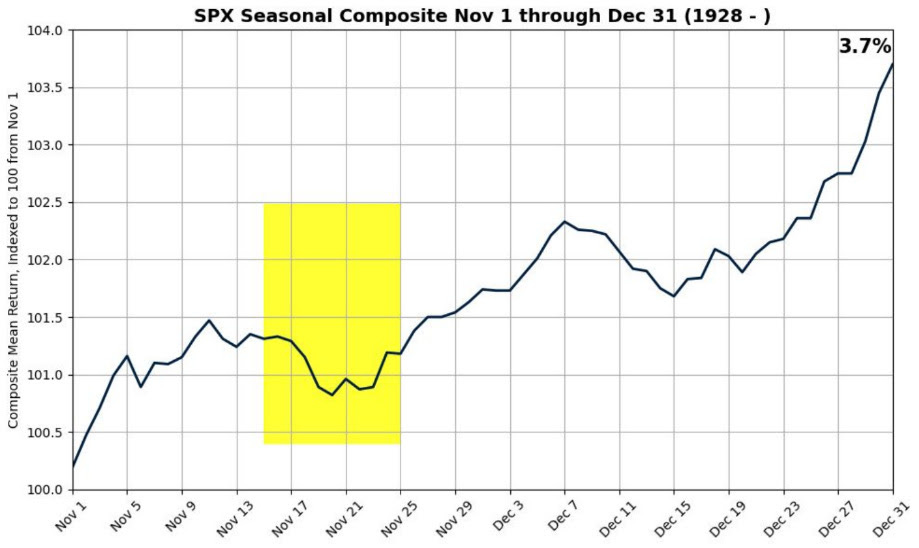

As mentioned in last week’s update, the risk of a pullback has increased, with December 6 being seasonally the local top. Absent that, I don’t see a reason why we shouldn’t get a Santa rally in the remainder of the year.

I am maintaining my exposure to broad-based indices.

I rotated some QQQ into IWM last week.

I may enter into a call spread on SPY, betting on the Santa rally (also given relatively good option pricing, see the Volatility section below).

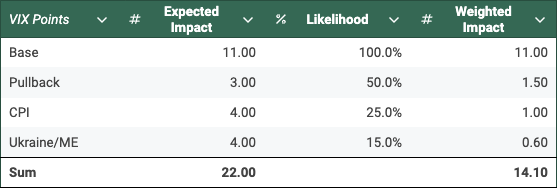

Volatility: Currently, I see the fair value of VIX around 14.1.

Seasonality and the holidays ahead suggest VIX of 11. I add 1.5 points due to a potential pullback, as explained above. I add 1 point due to CPI next week and the risks to macro and long-term yields. I add 0.6 points due to the sleeping risks around Ukraine and the Middle East. At the moment, I don’t see any events on the horizon that could push VIX above 22.

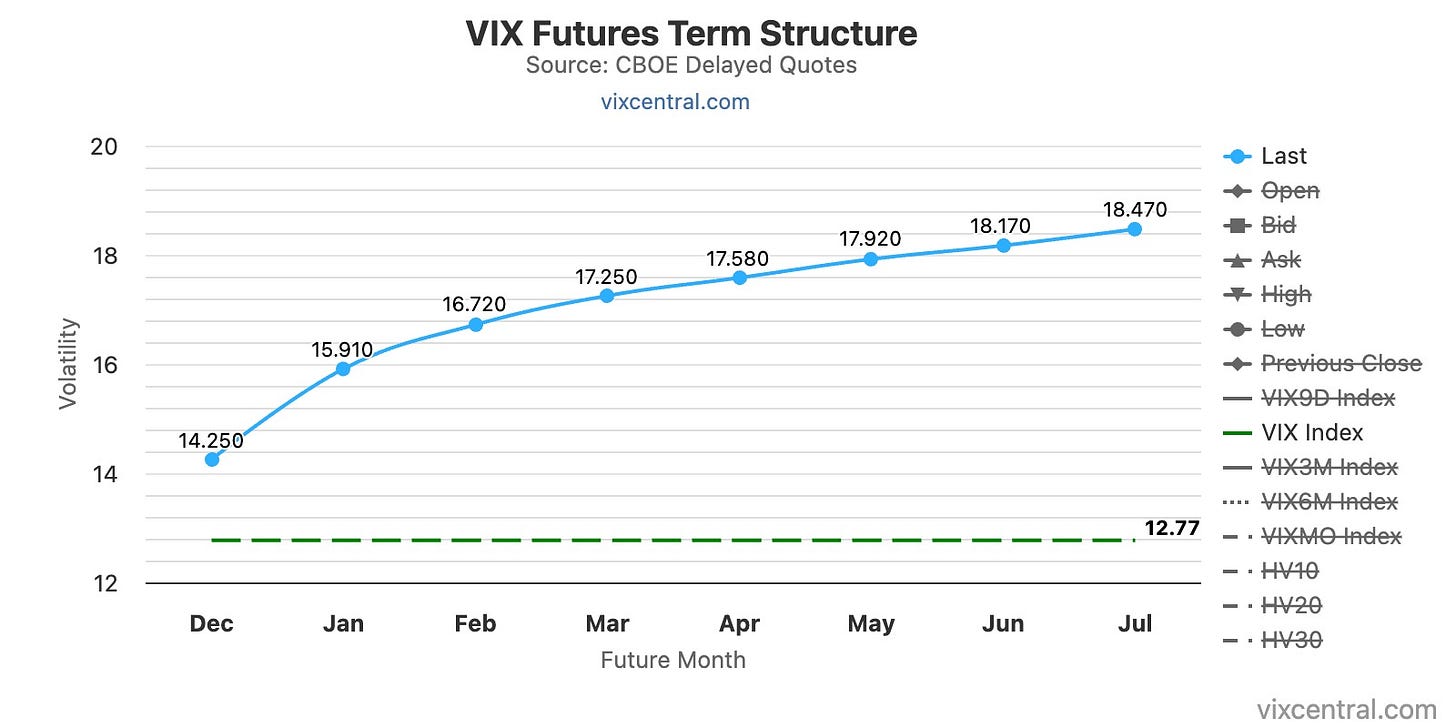

This week saw a steady grind lower in VIX to a 12 handle. Both the futures and term curves look normal. Realized volatility (RVOL) collapsed to 7.66. M1:M2 contango is high at 11.65%. Skew is high at 168.05.

Last Friday, I reduced my short UVXY and long SVIX positions by more than half, locking in a significant profit. Despite the present strong contango being a tailwind for these strategies, my general rule is that I exit short-vol positions when the VIX dips below 13. I still remain short UVXY and SVIX, just to a smaller degree, and with the intention to hold the position for a longer-term horizon over the Santa rally. However, I did sell covered calls against my SVIX position. I may sell covered puts against my UVXY position.

At the same time, I also increased my long-vol positions, using the February contract. I also kept my long-vol hedge built on the December contract, which is currently underwater. It would be nice to see a market pullback next week so that I could exit this hedge at a profit. In case of a continued low volatility environment and if I see the emergence of new risks, I have the space to double the long-vol position.

Bonds: The 10-year yield dropped to 4.15% and TLT rose modest 0.45%.

I entered into a ratio spread on TLT, Mar-21 +90C-2x100C.

Energy: Gorozen released a superb market commentary, further confirming my conviction in uranium. Another striking takeaway was that US shale oil and gas have reached a peak. Moreover, CNBC released a YouTube video on thermal batteries, an area I did not know about previously, and that is underfollowed. These trends have far-reaching implications and I will be looking to position myself lucky, beyond my current uranium bets.

I remain invested in uranium.

Crypto: Bitcoin surpassed $100k for the first time. David Sacks was appointed as the Crypto and AI Czar by Trump.

I remain invested in IBIT and ETH.

Other: I published an article on MercadoLibre this week - check it out. I plan to release another article on a certain single stock this week - stay tuned.

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.