Macro

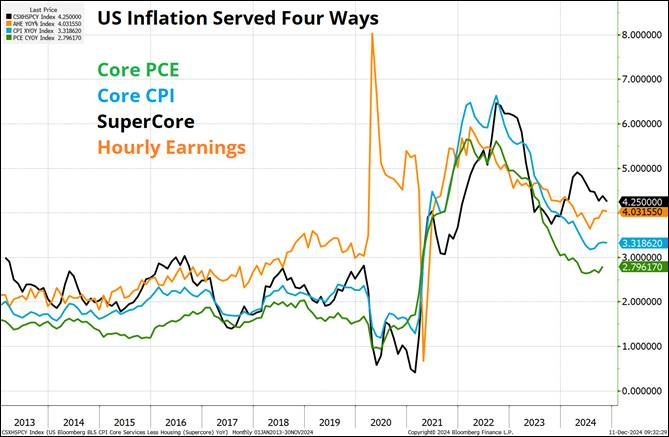

Last week we received CPI data. Despite data coming in on estimate, it reminded everybody that inflation is sticky, above target, and seems to have leveled off around 3%.

Last week I read a particularly noteworthy 2025 Economic Outlook by Apollo. My key takeaways are that the outlook for the US economy is strong, the equity risk premium has evaporated, and the leverage in the system is in financial markets, not the economy. This means we will likely get a pullback in equity markets next year driven by something other than the economic outlook, probably inflation.

Also, private equity and credit seem to have very good years ahead.

Next week we will get PMI data on Monday, retail sales data on Tuesday, FOMC and Fed rate on Wednesday, GDP and unemployment claims on Thursday, and PCE on Friday. It looks like a busy week, but my hunch is that all data will come on estimate or better. The Fed is set to cut rates one more time and then pause. Not cutting is unlikely and would lead to some short-term volatility. Note that following next week, there will be virtually no significant macroeconomic data releases until January.

Politics

I am including this new section, as politics may be in the driving seat of market action next year.

To start with, I find it likely that Israel will bomb Iran’s nuclear facilities next year. Why? Although political experts see the destruction of Iran’s nuclear facilities as ultimately futile and believe that whatever Israel does, Iran will still get a nuclear weapon, I think that Israel can never be sure that this is indeed the case. If they get the chance to delay/prevent Iran from obtaining a nuclear weapon, they will take it. Lastly, I think the new Trump administration will eventually budge to Israel’s pressure. This will lead to some short-term volatility.

Equities

SPX followed seasonality last week, being down around 0.7%. I find it likely that SPX will continue following seasonality until year-end. On average, people made significant capital gains this year and will be proportionally reluctant to sell before year-end.

Seasonality would imply the following year-end prices - SPY $613 to $616 and SPX $6,140 to $6,170.

NDX outperformed RTY by over 3%. Upon reflection, my earlier rotation from QQQ to IWM was premature and not well-considered. The only sector outperforming NDX was consumer discretionary and the worst-performing sectors were materials and utilities.

I will bet on the Santa Rally, either directly or through a call spread or a risk reversal on SPY or QQQ.

Volatility

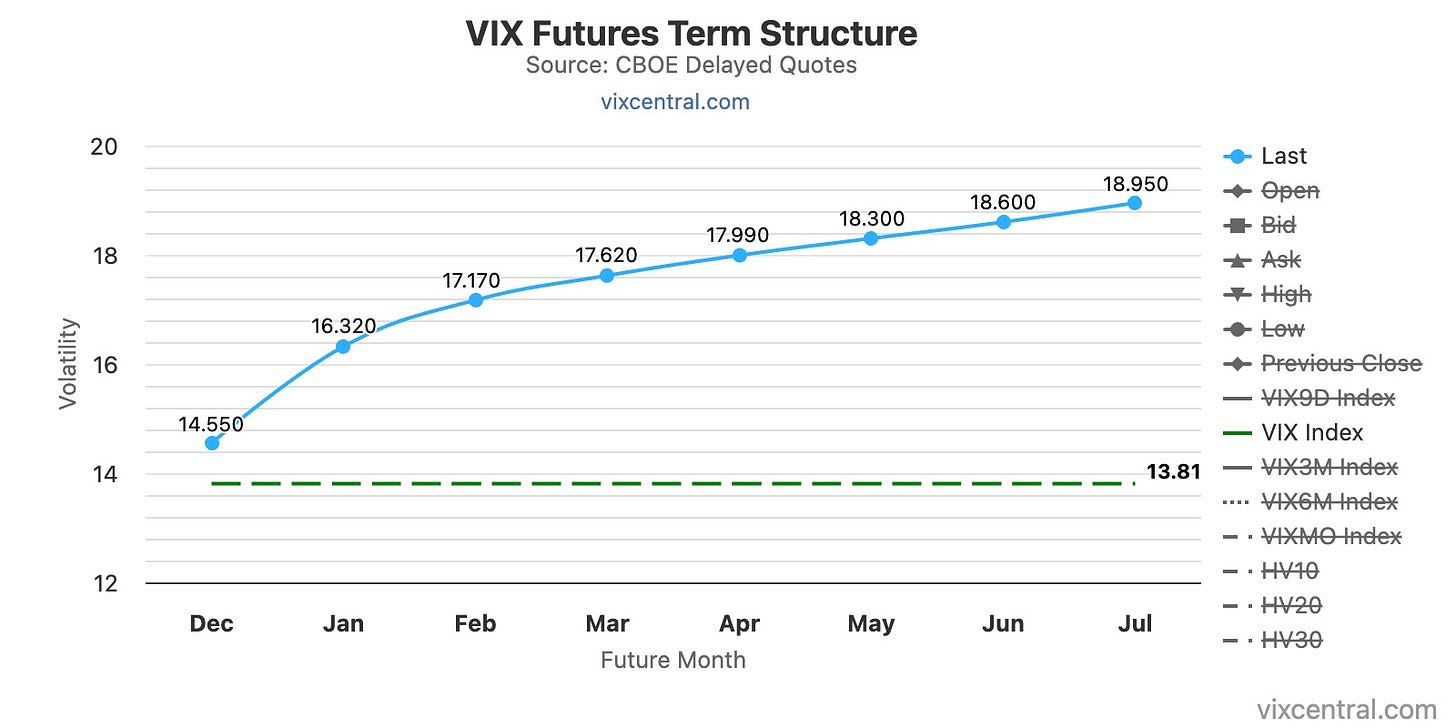

As presumed in the previous weekly update, last week saw a pause in the VIX’s grind lower. VIX reached 14.5 and closed at 13.8. The futures curve shifted up proportionally to VIX. Realized volatility (RVOL) remained low. M1:M2 contango and VX30:VIX roll yield remain high.

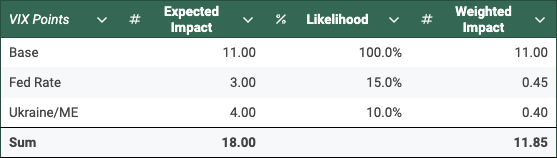

Currently, I see the fair value of VIX around 11.85, which is a significant drop from the previous 14.10.

Seasonality and the holidays ahead suggest VIX of 11. I removed both the pullback and CPI risks, as these are behind us. I added the risk around (the lack of) the December cut by the Fed. I keep Ukraine and the Middle East risks. At the moment, I don’t see any events on the horizon (until year-end) that could push VIX above 18.

After Wednesday, the VIX should be free to grind lower toward 12. Although it is against my rule to enter short-vol positions when the VIX is below 13, I plan to do it as the risk premium (the difference between the price of the futures and my fair value) is attractive.

I will enter into a risk reversal or a spread trade on UVXY or SVIX for the remainder of the year.

Bonds

On the back of the sticky inflation narrative, the 10-year yield increased to 4.4% and TLT dropped 4.5% to $90.15. It seems to me that the sticky inflation narrative should die down until we get the next CPI data.

I may increase my ratio spread on TLT if we see a 4.45% 10-year yield (a long-term trendline).

Energy

I remain invested in uranium.

Crypto

2024 looks to be a turning year for crypto (Bitcoin especially). Demand is getting more institutionalized with ETF approvals and Trump’s election win. Supply remains fixed. The economy is strong and crypto is to some degree isolated from a likely pullback in equities.

Many long-term (retail) holders are likely selling around $100k BTC. If this does not push prices lower, prices should go up significantly, once this selling flow dies out, and the structure of BTC holders becomes more conservative. This is supported by the fact that crypto balances held by exchanges are trending down.

I remain invested in IBIT and ETH.

I feel that I am underinvested and may increase exposure, including selling puts on IBIT.

China

The Great Wall Street had an interesting article on the overlooked trend of the rise of lower-tier cities in China. The major cities, such as Beijing, Shanghai, and Shenzhen, are becoming prohibitively expensive, and working-age people now find it attractive to move out to lower-tier cities, where they will have a better quality of life and higher disposable income. Within Chinese tech, companies that are seeing the benefits of this trend are, for example, Pinduoduo, Kuaishou, and Meituan.

I don’t want to pick stocks in China, so I will invest in KWEB, which has good exposure to the previously-mentioned companies and relatively low exposure to the Chinese tech laggards, such as Baidu, Alibaba, and JD.

I remain in FXI through a LEAP call.

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.