“Today was a closer call [on cutting rates by 25bps as opposed to keeping them unchanged].”

J. Powell, Federal Reserve Chair, December 18, 2024

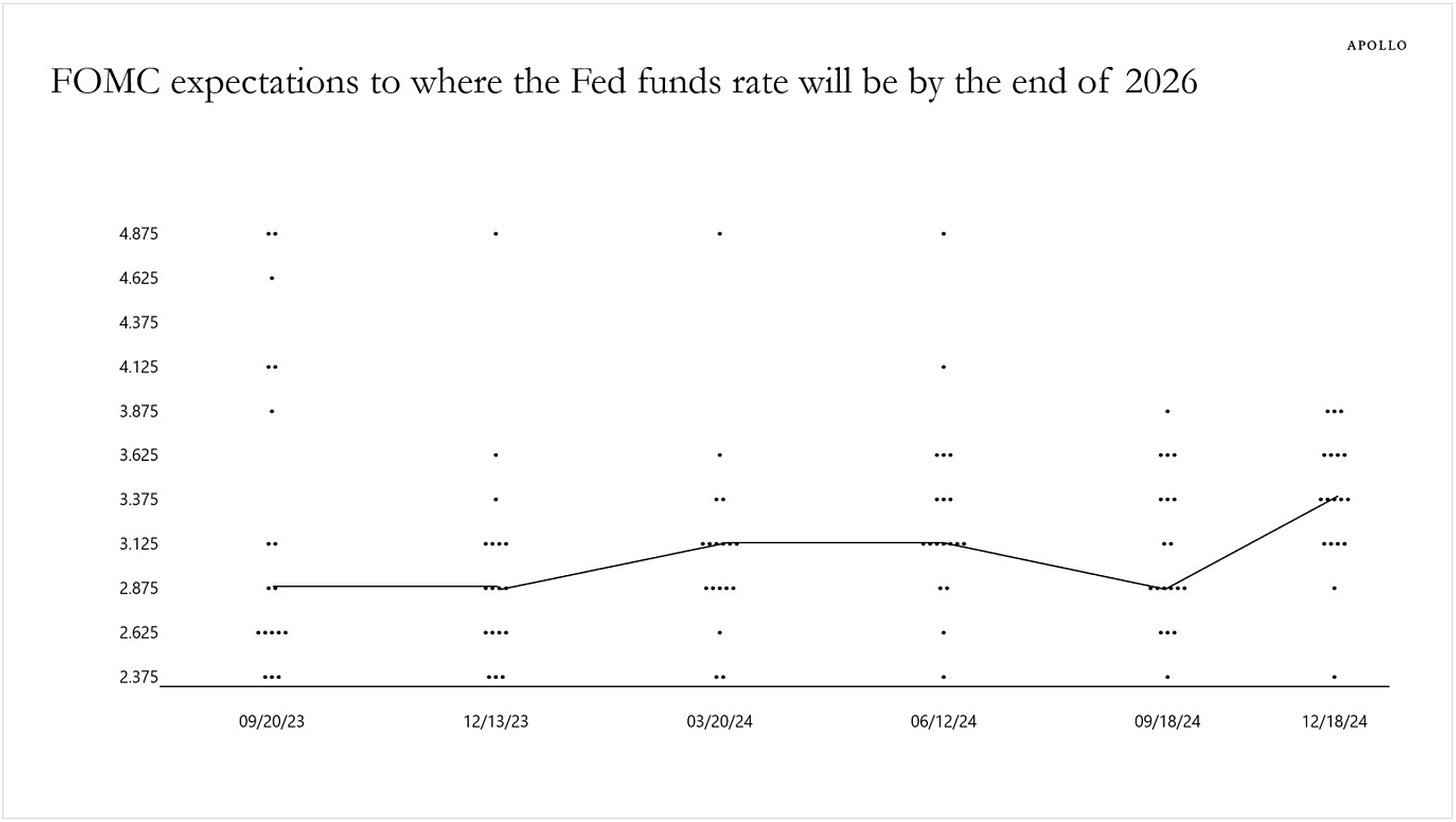

This quote epitomized the vicious volatility spike last week. Going into the December press conference, the market had anticipated a “hawkish cut,” and got it. But the hawkishness exceeded market expectations. Instead of the four cuts priced for 2025 prior to the press conference, now we expect two. As a result, higher-for-longer reclaimed its position as the base case scenario for 2025.

Macro

The Fed press conference spurred a sharp selloff. Both stocks and bonds sold off. Credit spreads did not widen and bond volatility did not spike.

This, in summary, signals that nothing fundamental was broken in terms of earnings and economic growth. Rather, the selloff was related to elevated equity valuations, their sensitivity to rates, and the extended positioning leading up to the press conference.

This tells us that the recovery should be quicker rather than longer. Early on Friday, I posted on X that I bet the volatility would start subsiding on Friday. It seems to have paid off. Once the PCE inflation numbers came out that day lower than expected, the market exhaled and the volatility started dropping.

Regarding the upcoming weeks, no key macro releases will be available until the first week of January.

Politics

Not only did we get some action in the markets last week, but we also witnessed intense political drama around a government spending bill. The drama included nothing less than the display of Musk’s political power, the last-minute changes demanded by Trump, and over 30 Republicans breaking the party line. Mind you, all that happened while Trump is not even in office yet.

While it’s early to draw any firm conclusions, what could the events of this week signal for the upcoming years? It showed that individual Republicans throwing a wrench in any legislation is not out of the question. Second, Musk’s power is significant, and DOGE will be a driving force over the next two years.

Most importantly, though, the extension of the debt ceiling suspension did not pass and will cease on January 1, 2025. This means that the treasury will not be allowed to issue any net new debt and that the treasury’s TGA account will be drawn down. This situation could persist until about late summer when the treasury is set to run out of money unless the debt ceiling is lifted/suspended again. The upcoming undersupply of treasuries and the drawdown on the TGA account can (and likely will) lead to some positive flows and liquidity, providing a tailwind to asset prices. More information on the mechanics here.

Equities

SPY closed 2.16% lower compared to the previous week’s close, while at one point it was down 3.8%. Factor-wise, growth was the only factor that gained last week (+0.55%; large-cap growth performed the best), while small-caps performed the worst (-3.62%). This confirms that growth fares well in the face of increased rate and inflation expectations relative to other factors.

Funnily enough, as noted in a previous weekly update, the semi-capitulation of David Rosenberg marked the absolute top (just one day early).

On Wednesday I exited my put selling program altogether to increase my available margin for short-vol trades (see below).

Volatility

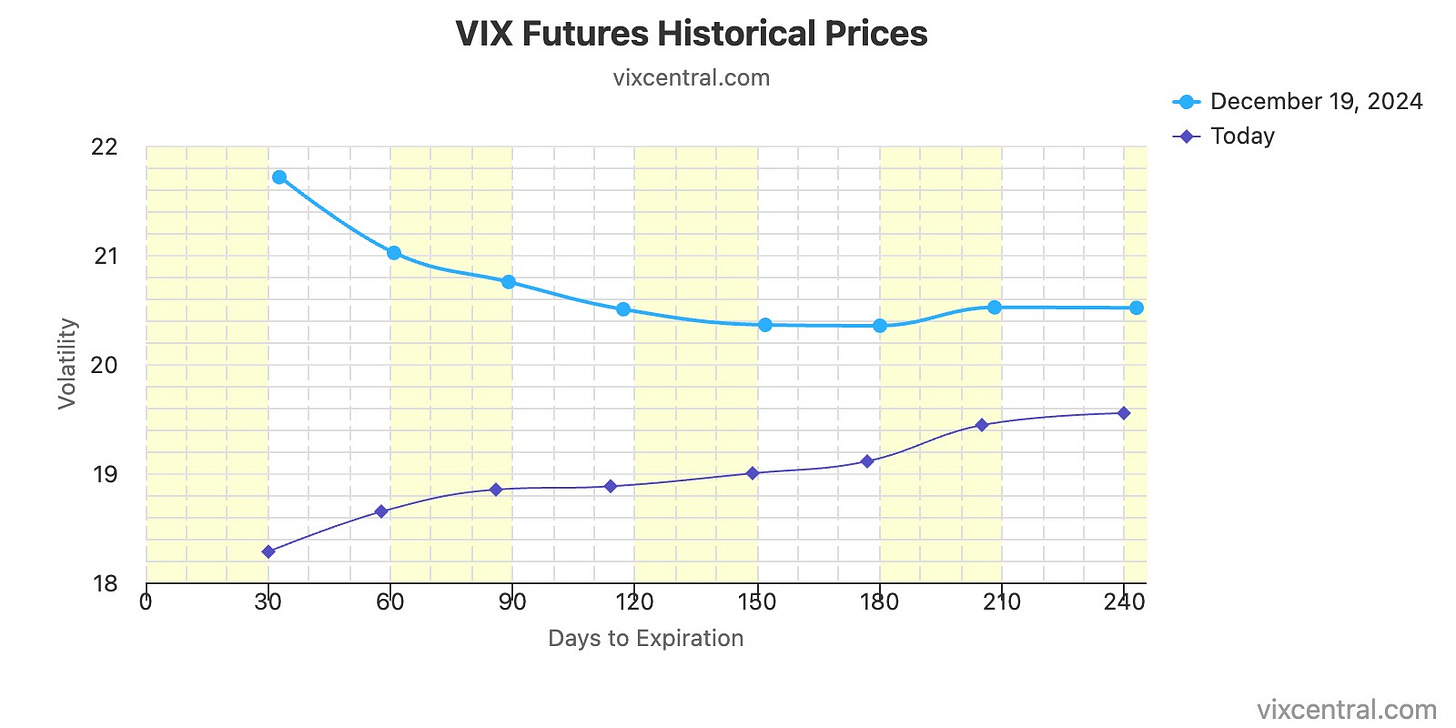

I was dead wrong in my previous weekly update as VIX spiked ferociously last week, reaching over 28 and closing at 18.35. The futures curve shifted to backwardation but returned to contango on Friday (staying backwardated for only two days).

The speed and severity of the spike and the return back from the peak reflect a new regime that we need to adjust to. We need to be bolder when betting long-vol in terms of the magnitude of the move and be quicker in expecting a return to normalcy.

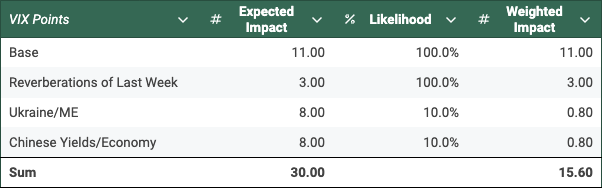

Currently, I see the fair value of VIX around 15.6. However, given that we are just coming off a massive spike, I don’t see the fair value metric as highly relevant this week.

Seasonality and the holidays ahead suggest VIX of 11. Volatility tends to have a memory, so I added 3 points for what happened last week. I kept Ukraine and the Middle East risks, but I increased their magnitude (in line with the changing regime, as outlined above). And I added some risks related to the Chinese yields.

Last week I entered a large short-vol position on UVXY and VXX.

Bonds

The 10Y yield increased to 4.525% in line with the narrative outlined above.

I entered into a significant position in BIZD, given that SOFR is likely to stay elevated for longer.

Energy

I remain invested in uranium.

Crypto

I remain invested in IBIT, ETH, and DOGE.

During the volatility of last week, I increased my IBIT position by 50%, which I plan to reduce once Bitcoin crosses $100k again.

I also plan to exit ETH and DOGE and remain only in IBIT going forward.

China

The Chinese 10Y yield keeps dropping well below 2% as their economy slows down, as it battles deflation, and as the debt burden rises to 3.7x GDP. This situation could spur a volatility spike, but I will need to consider this effect closer to fully understand the implications.

Other

This week I entered several (mostly speculative) positions, taking advantage of the selloff, namely HIMS, CBL, MELI, and OXY.

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.