Recap of Last Week

Last week was Thanksgiving, and it was quiet. We did not get any unexpected events or moves in the markets. So instead of talking about the (relatively insignificant) events of the past week, I will quickly touch on my performance in November.

In November, my portfolio’s net liquidation value grew by 14.6%. The main contributors were i. short tail, ii. short volatility, iii. long bitcoin, iv. short DJT, and v. long indices and equities. The main detractor was long China. This performance is in excess of my targeted performance of 3% per month, and I don’t expect similar performance to be usual going forward. November was impacted by my bet on the US elections, where I saw a large probability that the election would end up as it ended up, and at the same time I saw relatively small downside risk if it ended up differently.

Preparation for the Upcoming Week

Macro: Preliminary GDP and unemployment claims came in on estimate. Next week we will get speeches by Waller and Powell, employment data, and services PMI.

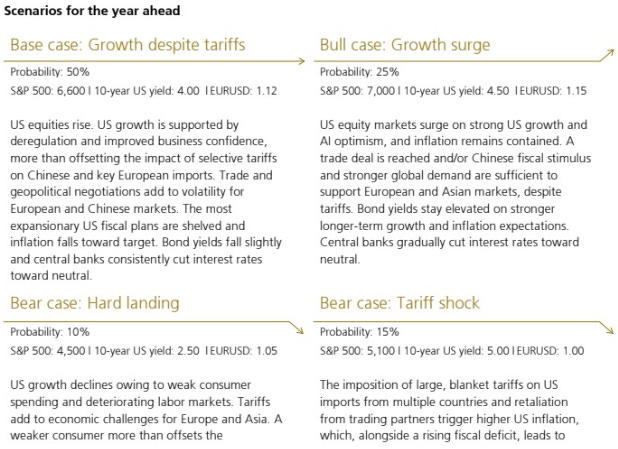

Equities: I find the below 2025 scenarios from UBS broadly in line with my expectations and a good footing for thinking about the upcoming year. This says that the expected value of SPX for next year is 6,265, 3.9% above the current value. The base case is 9.4% above the current value, in line with the historical growth rates. The upside is only 16.1% relative to the drawdown risk of -25.4% in the worst case and -19.4% when I weigh the two bear cases. In summary, not terrible, but I would like it better if the downside risks were reduced in probability by ~10%, which would put the expected growth at 6.9%.

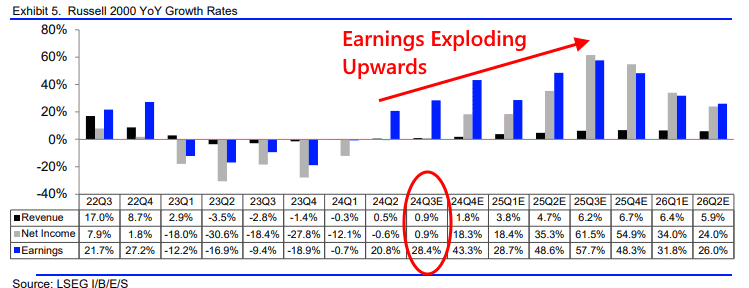

The below screenshot shows that IWM earnings are very likely to explode. Put this together with the relatively expensive MAG7 and I see a good chance that IWM will outperform QQQ in the coming year.

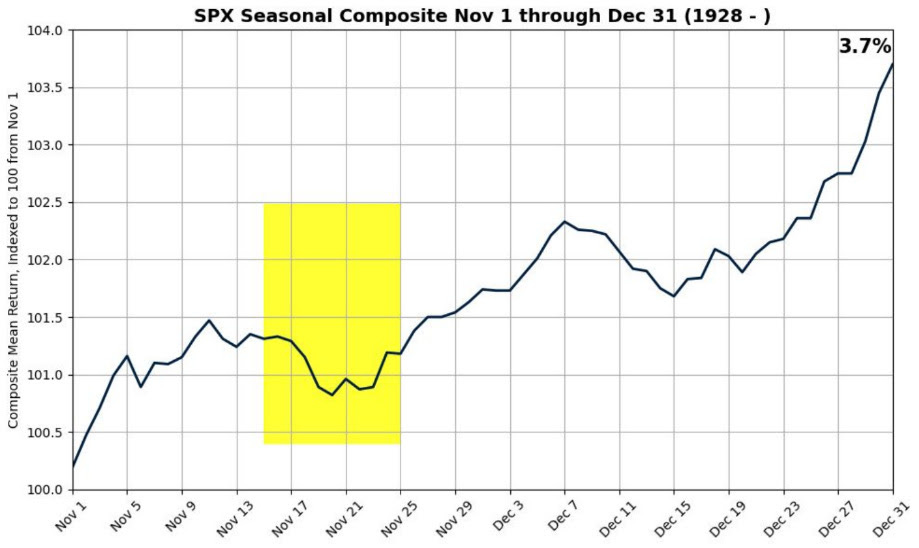

From a shorter-term perspective, the risk of a mild pullback has increased. The put-call ratio has spiked, which has recently been a relatively reliable indicator of a pullback. Also, seasonally we should see a dip the week following the next week.

I am maintaining my exposure to broad-based indices.

I will rotate some QQQ into IWM and RSP; I will add to my exposure if we get a pullback to take advantage of the likely year-end rally.

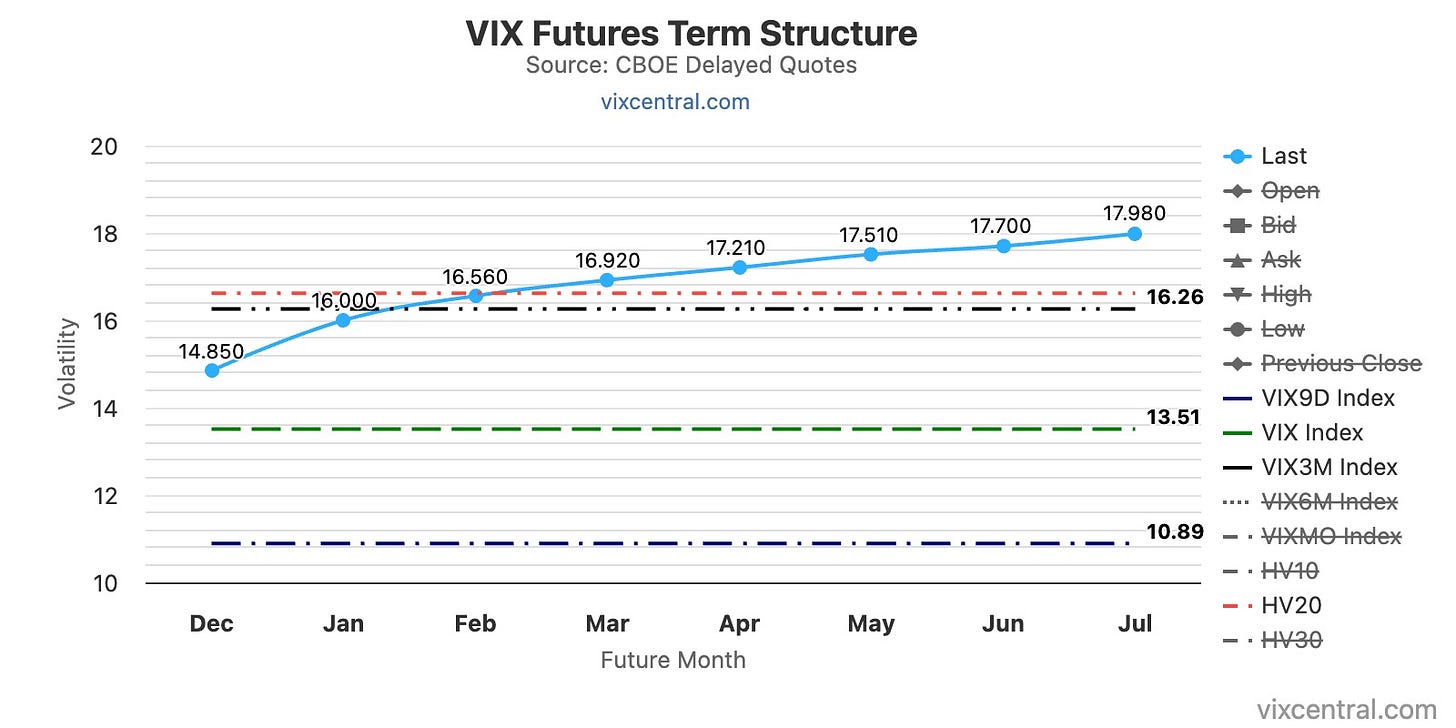

I don’t plan to sell puts this week unless we get VIX above 17.

Volatility: My VIX fair value forecast for next week is 14.5 to 15.0.

Base value: Seasonality and VIX9D suggest 11 points.

Adjustment for catalysts next week: +1.0 points for macro around employment, ISM, and the Fed’s positioning. +0.5 to 1.0 points as long-end yields’ contraction could reverse. +1.0 points due to a potential pullback, as explained above.

Adjustment for the emergence of mid-term narratives: +1.0 points for the risk that the war in Ukraine escalates.

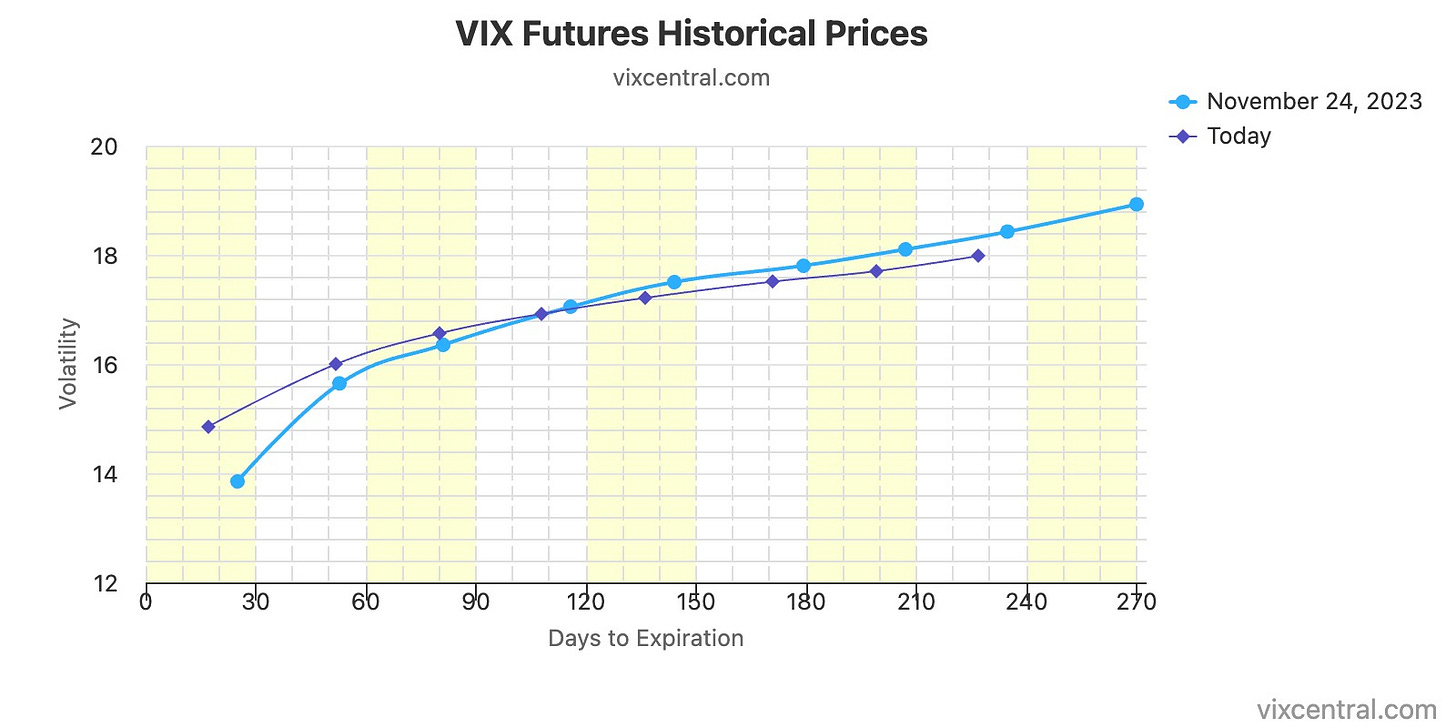

Both the futures and term curves look normal and above my fair value estimate. The futures curve is still somewhat above last year’s post-Thanksgiving curve. Realized volatility is relatively high at 16.62, unchanged from last week, and above VIX3M.

I remain short UVXY and long SVIX.

I may increase my long-vol hedge as VIX dipped below 14.

Bonds: As expected in last week’s update, the appointment of Bessent was bullish bonds, and the 10-year yield dropped to 4.18%. The 10-year yield respects the trendline. It feels like this should continue and the yield will continue dropping.

I may enter into a spread on TLT, +90C-2x100C expiring in January 2025.

Energy: I released a primer on uranium last week - check it out, it outlines the fundamentals of the market as well as my positions.

I listened to a webinar by Argus on the SAF market (a great source for chemicals and fuels news) and decided to shelve NESTE. The SAF market, being a key driver for NESTE, is in a supply surplus that is set to last for another decade, which is worsening from the previous projection of around 2 years of supply surplus.

Crypto: My current feeling is that Bitcoin can remain around $100k for the coming month or two, but after that, it will retrace back down, where I would be a buyer.

I trimmed some of my speculative crypto positions last week.

I will keep only some IBIT (~2% of portfolio) for the long term, the remainder I will be selling as needed for other positions.

Other: Being fully allocated to broad-based indices, which are quite expensive now, I am focusing more on certain individual stocks, which I will disclose in the coming weeks.

I closed DJT short for 86% profit, after 20 days in trade.

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.