Macro

Now that we are in 2025, nothing has changed vis-a-vis the two key macro themes - the focus points remain unemployment and inflation. In terms of more actionable narratives informing the two themes, focus points for the coming few weeks will be Trump’s policy and earnings.

The market will be looking for signs of whether Trump’s policy will lead to a risk of a recession (sharp spending cut) or inflation (shock and awe tariffs, tax cuts, deregulation). The FX and bond markets are already pricing in some Trump uncertainty (see the respective sections below). Should no extraordinary policy be realized, this Trump premium will be priced away. Vis-a-vis equity markets, the impact of the inflation-impacting policies is not clear. The impact of the growth-impacting policies is very strong and would drive credit spreads way up from the current low levels.

As earnings season starts this week, the market will again look for signs of recessionary or inflationary data points. EPS forecasts and valuation levels are aggressive and SP500 concentration is high, so the downside is larger than the upside - earnings cannot show any weakness for the market to continue climbing. And of course, NVDA will take center stage.

The key macro data points next week:

Politics

It’s all about the newsflow around Trump’s policy changes.

Equities

Grey horizontal lines show JPM collar strikes. We aren’t close to any important price level (except perhaps the 100D moving average).

Seasonality does not bode well for the next few months. The December selloff may have pulled forward some of the January weakness, but February is no better than January. Historically, January has been a telling indicator of how the rest of the year will shape up. If the market is up (or down) in January, it implies it will continue to rise (or fall) for the rest of the year. The win rate is 89% with an average annual return of 16.8% (versus -1.7% return when Jan is negative).

I plan no changes next week to my exposure until we reach some significant price level.

If we reach SPY of around 610 and VIX below 15, I will buy a put as a hedge.

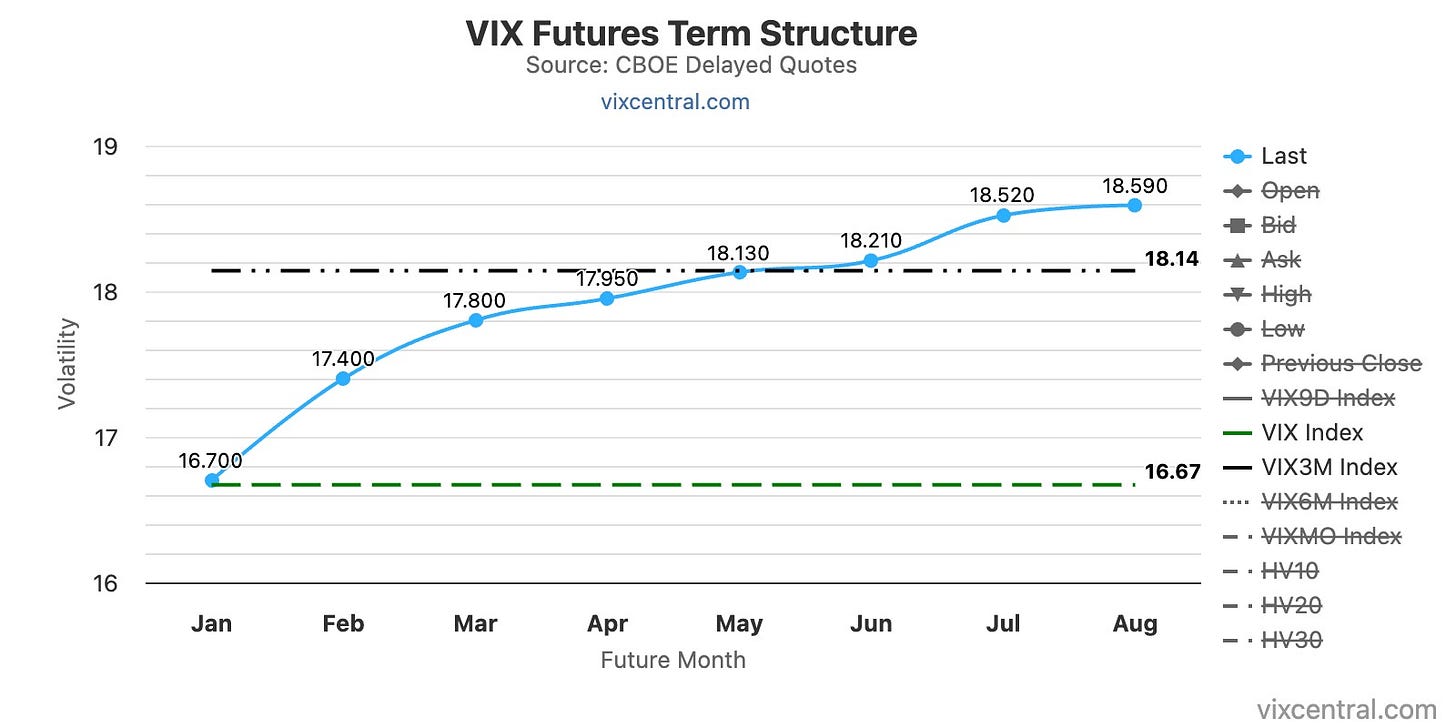

Volatility

Last week saw a second ripple of volatility with VIX reaching 19.5, and on Friday we saw the familiar Friday crush, with VIX ending at 16.1.

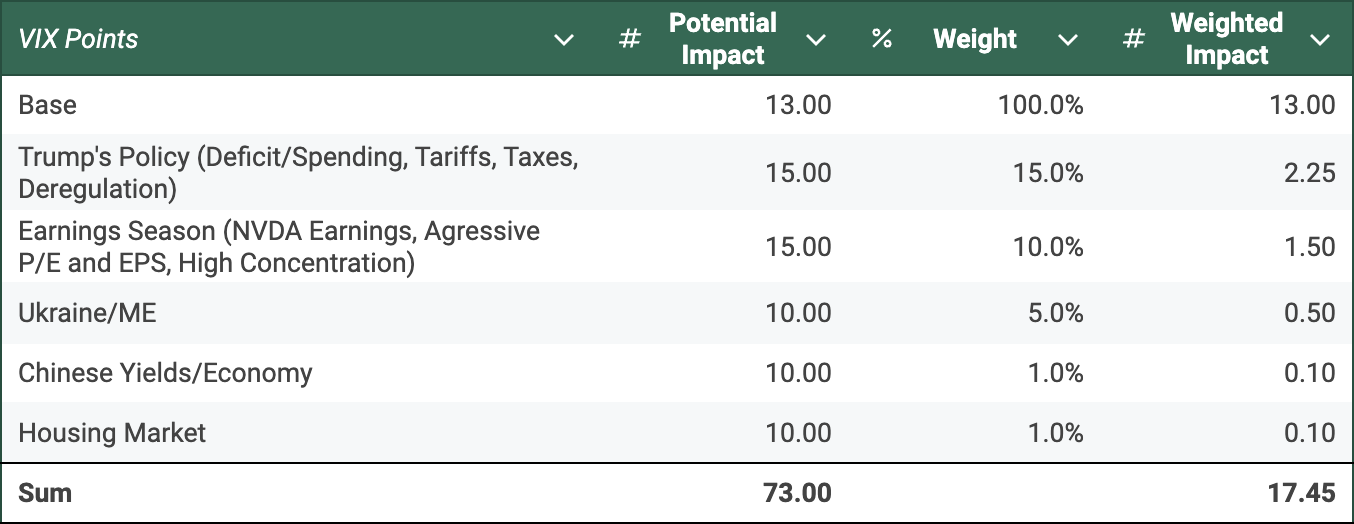

Currently, I see the fair value of VIX around 17.45.

Seasonality and SPY price action suggest a VIX of 13. The key risks are the above-discussed narratives around Trump’s policy and earnings season. I keep the Ukraine and Middle East risks. I added risks around the deflationary balance sheet recession in China. I also added risks around the US housing market. Citrini and others have recently pointed to the growing inventory in the major US markets. Moreover, mortgages are slowly being rolled into higher-rate mortgages. The housing market is huge, so it warrants keeping it on our risk watchlist. In summary, there are risks that could push VIX significantly higher.

My short-vol trade from a few weeks ago paid off handsomely. I exited about half and will exit the remainder if UVXY drops below 18.

If VIX drops below 15, I will start entering tactical long-vol trades.

Bonds

One can observe the divergence between the US 10Y yield and the US Economic Surprise Index. The market is pricing a Trump uncertainty premium. It seems that the market may be overpaying, as the magnitude of the tariffs’ inflationary effect is likely small at just 0.3 percentage points. Bonds should rally once this uncertainty clears, barring any shock and awe scenario of extreme tariff measures.

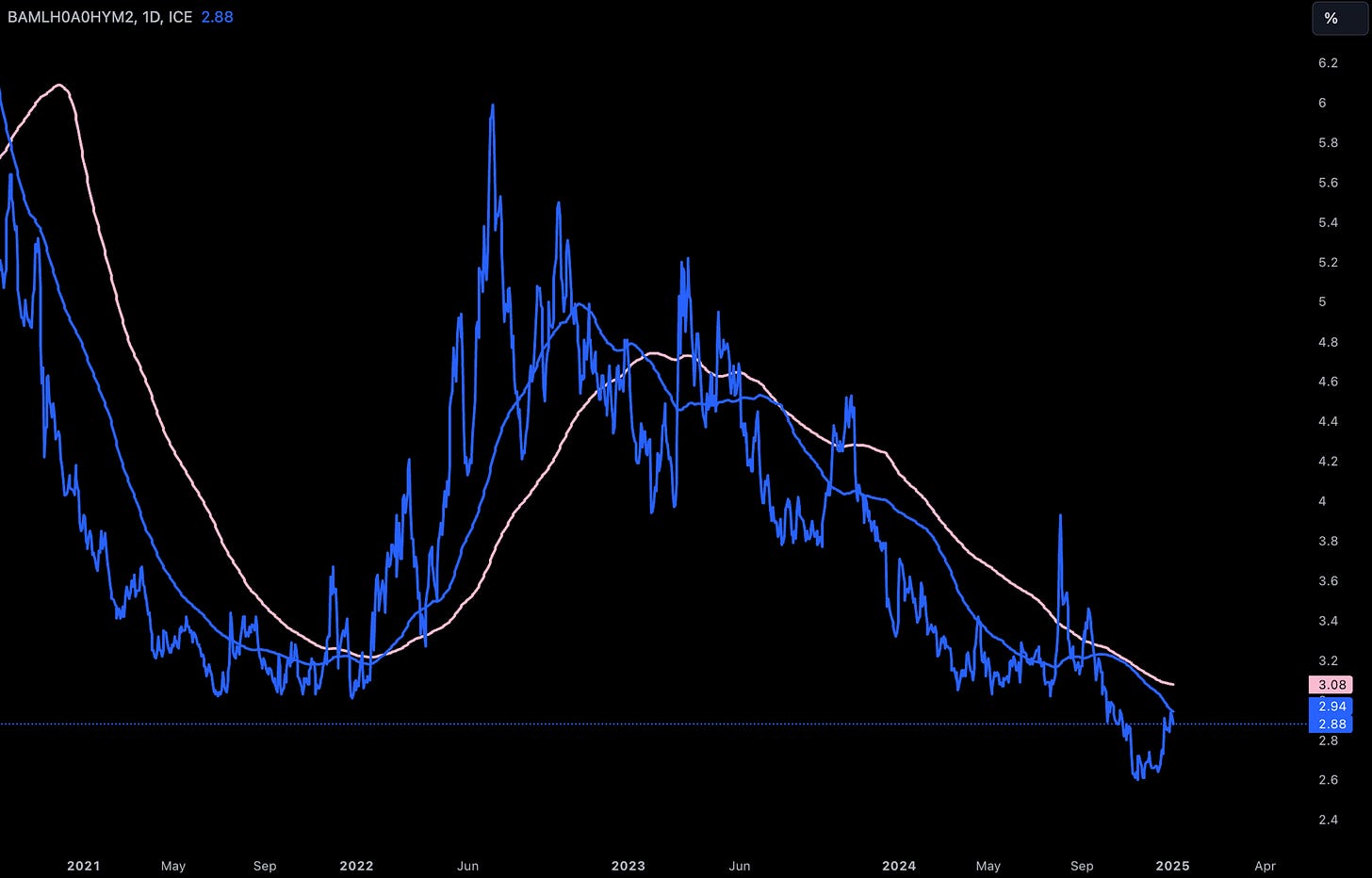

Regarding corporate bonds and private credit, we should keep track of credit spreads, which are very low at this moment.

If the US 10Y yield reverses on Trump’s policy announcements, the TLT would be set to rise to somewhere between $95 and $100. I plan to enter a spread to bet on this range, targeting to pay zero premium for the position.

A simple long TLT is a great way to hedge recession risk. I may enter a small position.

In the last few weeks, I bought BIZD. Private credit now yields over 10%, which I find highly attractive compared to other income options (corporate bonds, preferreds, MLPs, REITs). Long BIZD is a bet on higher-for-longer, so one needs to monitor this scenario closely.

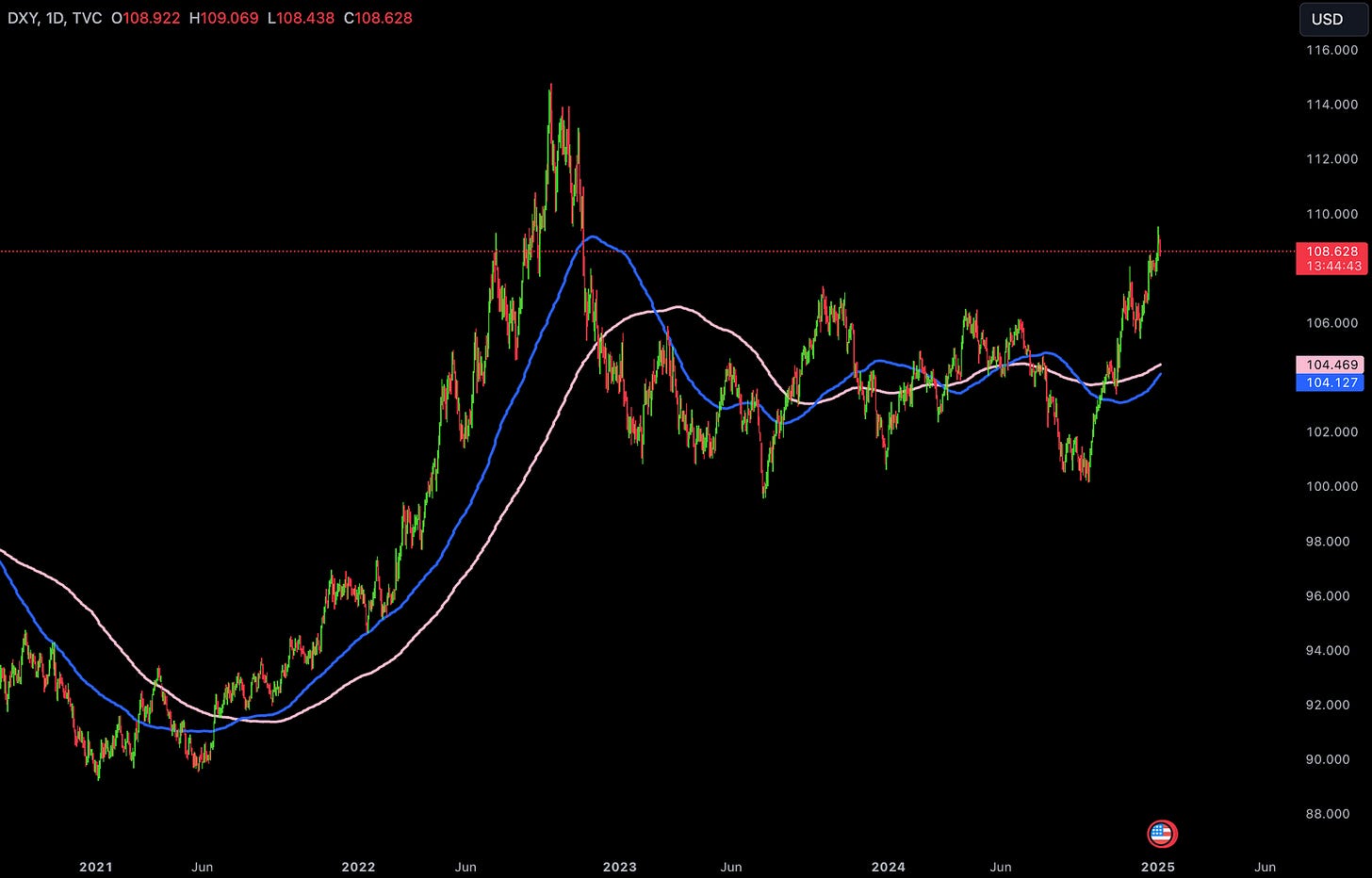

FX

Tariffs are bullish USD, and the market is heavily positioned with DXY at above 108. Right now, USD longs need a lot to go right to make money. They need big tariffs on Day One, or strong US economic data, or some fiscal spigot release signal from the new administration. If Trump enacts a 10% global tariff or a 25% tariff on Canada and Mexico on January 20th, the USD is going up, not down.

The majority of my holdings are in USD. I plan to diversify away from USD into EUR and CZK.

Energy

We saw a good amount of volatility last couple of weeks in the uranium market. There were certain announcements from Kazakhstan portraying the Kazakhstan government taking a larger share of the uranium market value, a short-term tailwind to global uranium prices.

Crypto

I exited my crypto positions. The risk/reward ceased to be interesting for me here, as it is essentially a leveraged equity bet. Moreover, I view MSTR as a systemic crypto risk, akin to LUNA in 2022. I would enter again at a more attractive level.

China

Chinese yields continue sliding amid deflationary balance sheet recession. I haven’t fully examined and considered the situation so I am staying out for now.

Other

Japan has good potential given its low valuation levels and cheap yen.

A nice article on MELI. It highlights the risks of competition, mainly from AMZN.

I am becoming increasingly excited about GOOGL. Why? My personal experience is that Claude and Gemini lead the AI race. I find it highly likely that GOOGL will eventually win as they are the only player that has made large investments into infrastructure, has a scientific advantage, has a platform advantage (Google Workspace), and has the most to lose. The valuation is attractive compared to the rest of the MAG7.

I plan to increase my exposure to GOOGL.

Happy New Year!

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.