Macro

Labor market data came in very hot last week. 256k jobs added vs. 160k consensus and the unemployment rate dropped to 4.1% vs. 4.2% consensus.

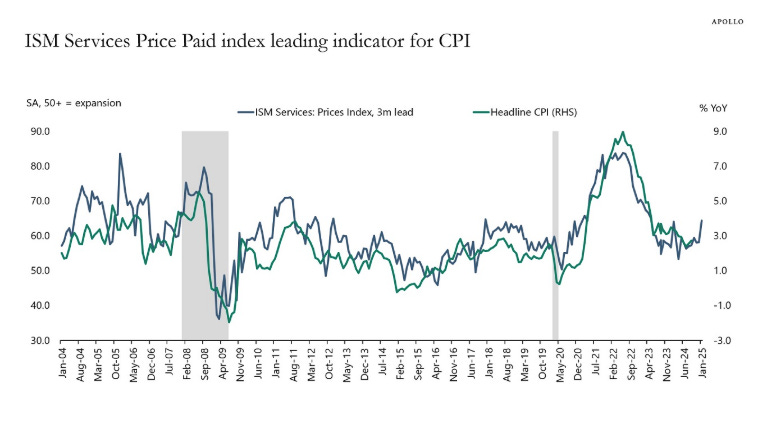

ISM data came in hot as well foreshadowing reaccelerating inflation.

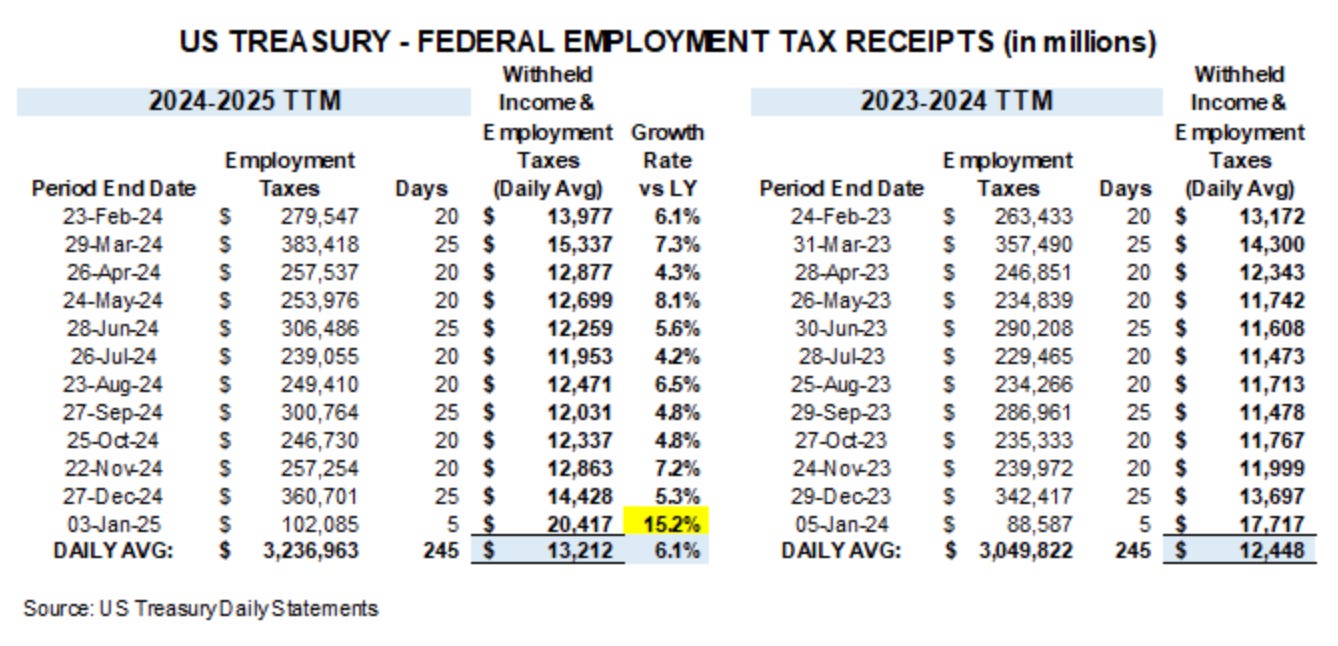

The bottom line is that all indicators (see this deck by Apollo) are coming in quite strong across all dimensions (labor, inflation, and GDP), and expectations are growing for the future. Very tellingly of how much money consumers have, the tax receipts are surging.

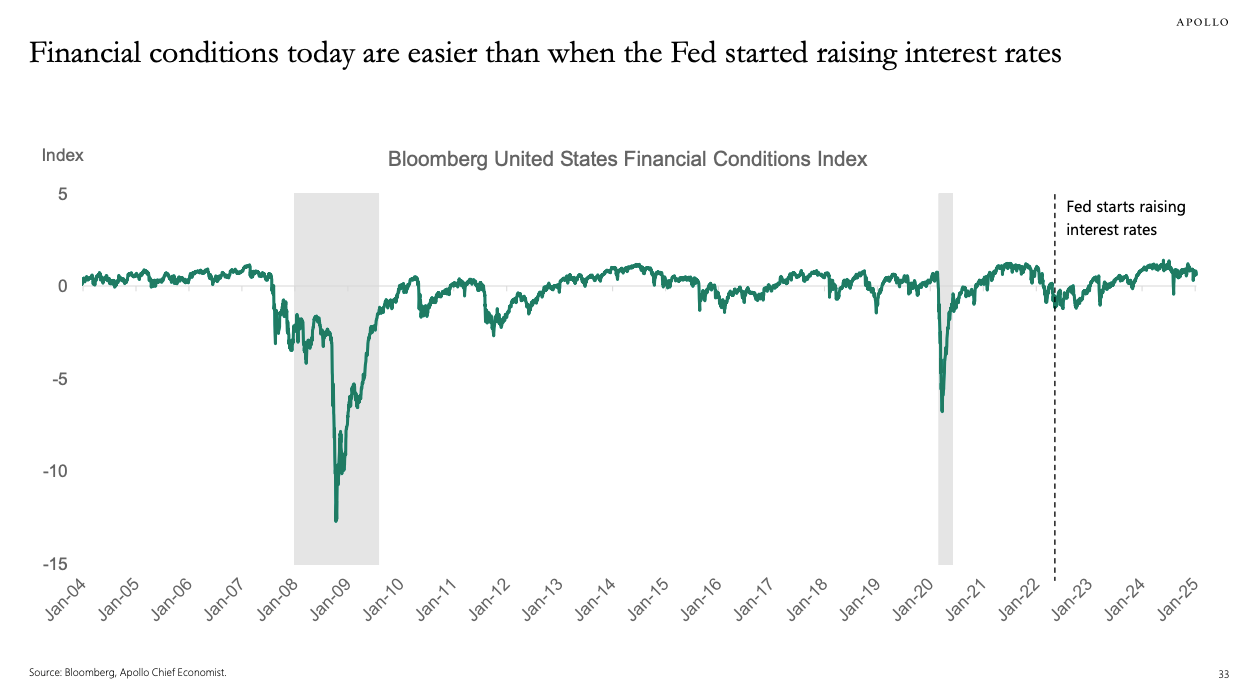

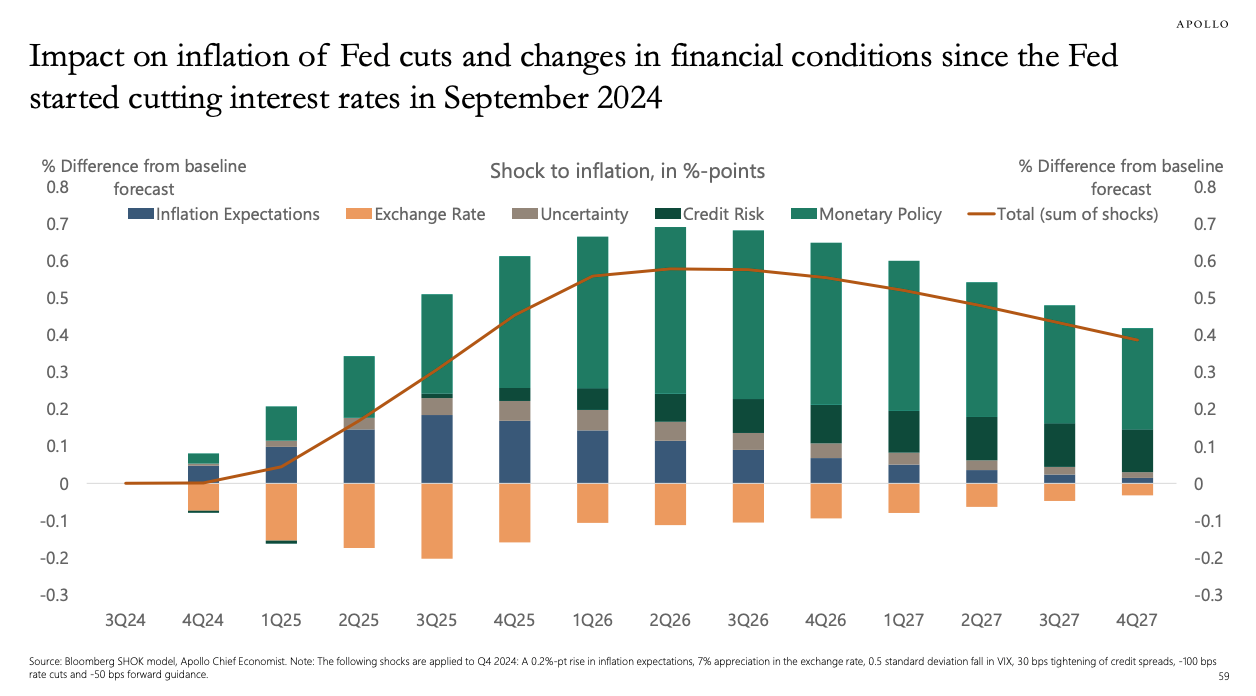

This is the result of the recent loose financial conditions, and we are now starting to see a positive impulse to inflation.

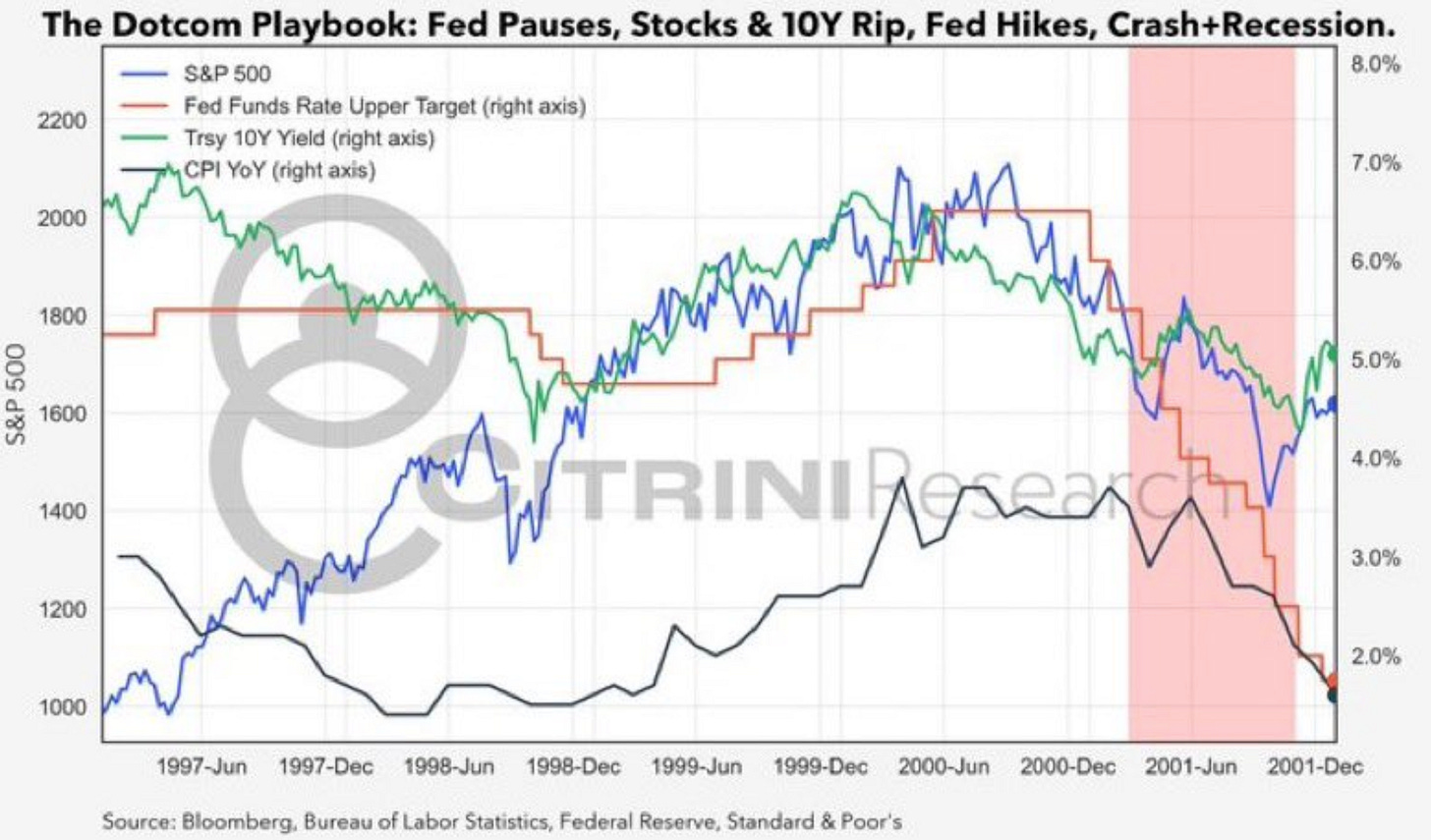

The data last week led the market to price out Fed rate cuts in 2025 and the market will likely start pricing in rate hikes. In summary, we are now exiting the “Goldilocks” regime into a “good news is bad news” regime. It can be counterintuitive that the market would perceive strong economic data as bad. It does so because runaway inflation has now become the primary concern. The market is worried that the more inflation runs away to the upside, the higher the risk that it will then crash down and result in a recession. For a historical reference, look at 1999.

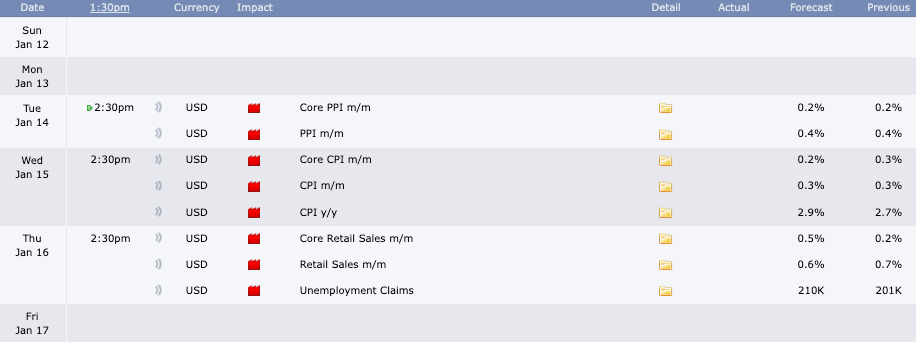

Next week we will receive inflation data:

Based on the above, I suspect that the inflation data will come in hotter than forecasted, definitively placing rate hikes back on the table.

Politics

Trump held a pre-inauguration press conference and a gathering of republican governors last week.

Equities

Equities’ weakness continues with the SPY down 2% since the previous week’s close. Given the repricing of rate cuts, growing yields, the uncertainty around Trump’s policies, the earnings ahead, the high valuation levels, negative gamma (where selling begets further selling), poor liquidity in the past few months, and poor seasonality, I am very cautious now. Equities are now in a transitionary phase and this can turn out to be a run-of-the-mill correction or a larger correction closer to somewhere around $560.

In any case, I find it hard to imagine the market going up next week, unless the inflation data next week comes in relatively cold. I will be closely watching if we break out of the blue channel.

I plan no changes next week to my exposure until we reach some significant price level.

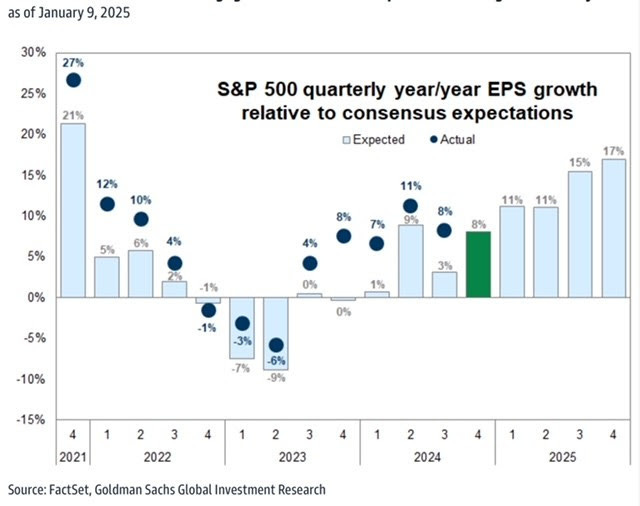

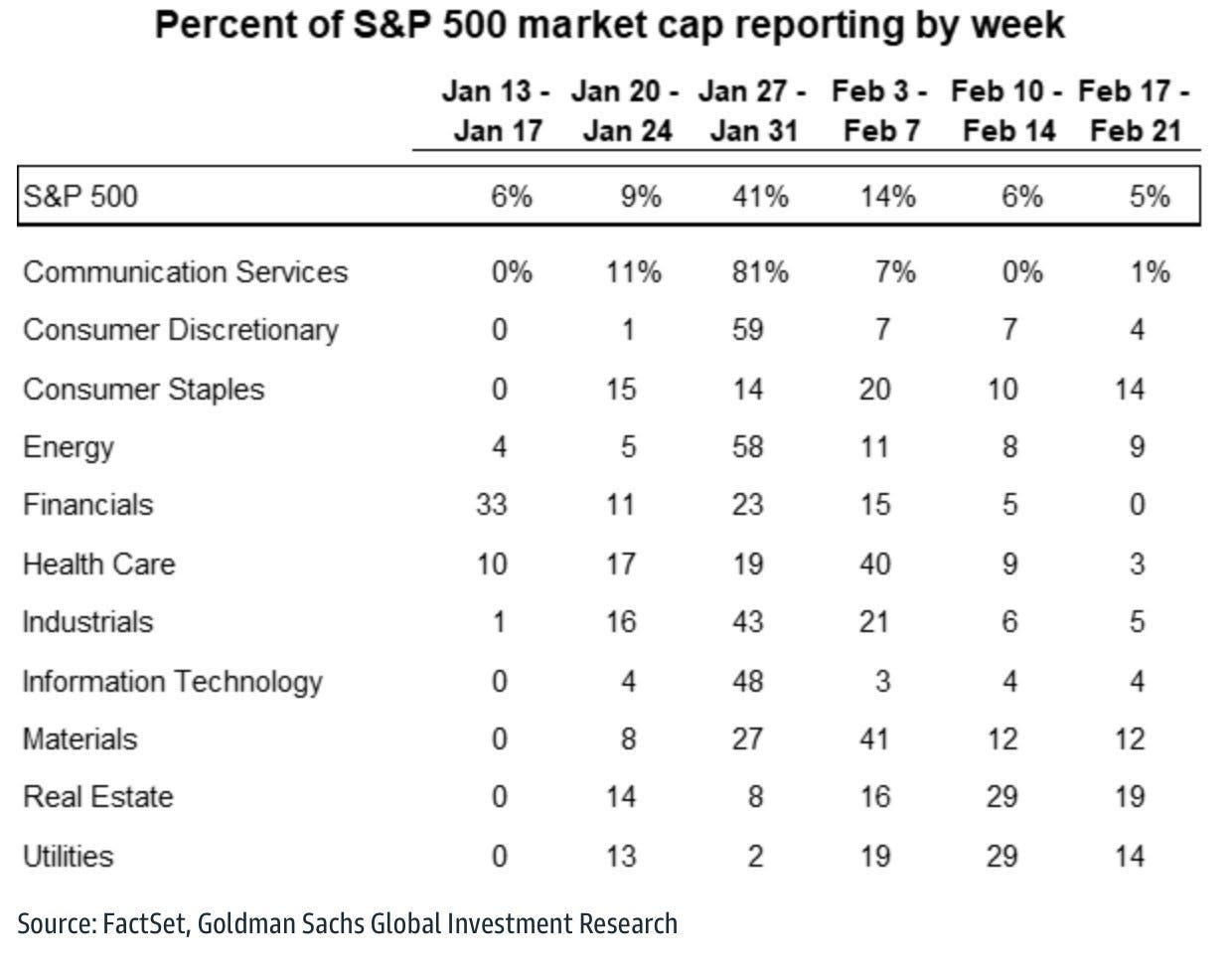

Earnings

Last week, Walgreens and Delta Airlines stocks were up 28% and 9%, respectively.

Next week will be heavy on financials. Key topics to watch for:

Tariffs and how companies are positioning.

Bank outlook for lending with the deregulation agenda coming.

Impact of USD on earnings. This is quite important as the dollar started rampaging in Q4 and overseas revenues are over 40% of the total.

Volatility

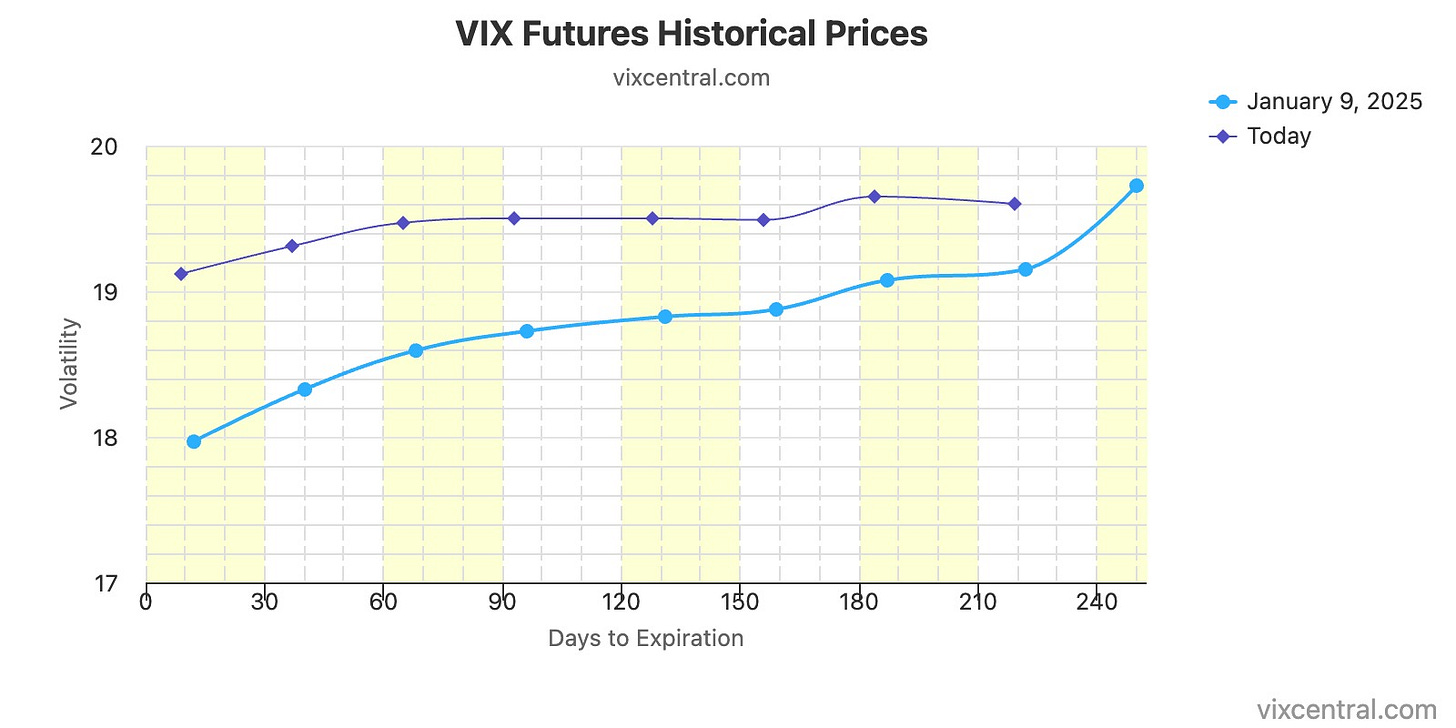

Until Friday last week, volatility remained relatively unchanged. On Friday however, the whole futures curve shifted up to low-to-mid 19s. The VIX ended at 19.54.

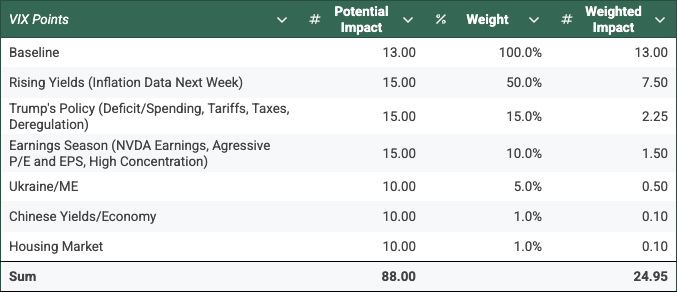

Currently, I see the fair value of VIX around 25.

Compared to last week’s risk assessment, I have added the risk of rising yields with a high 50% weighting. I do expect a hot inflation print next week and I believe equity markets have not yet fully grasped this reality and will sell off. Should the inflation print next week remain fine, this risk would fall away and the fair value of VIX would then be around 18.

I maintain close to 50% of my short-vol position, which I would consider hedging if the pricing on Monday would be attractive.

Bonds

The 10Y yield reached 4.79% last week on the back of term premium and inflation fears. This level is generally seen by the market as a threshold above which risky assets will sell-off. Also, observe the volatility of bonds, MOVE. Currently, at 96, there is no reason for concern, but values above 120 would indicate a crisis.

I am waiting for next week’s inflation data to see if the 10Y yield can rise above 5%.

The current yield levels are also undesirable for the Treasury and Trump as the interest service on the US government debt is becoming untenable.

I am observing for any intervention from the Treasury or the Fed.

FX

In line with the rising yields, the DXY strengthened to just shy of $110. Again, we are coming close to a level above which risky assets will sell-off. After next week’s inflation data, the next path for USD will be determined by the tariffs.

Severe tariffs would have the USD rally by 3-5%. This would occur if blanket tariffs are imposed, China tariffs 2x or 3x from the current levels, or we see severe 25%+ tariffs on Canada and Mexico.

Moderate tariffs would have the USD go sideways. This would occur if moderate targeted tariffs were imposed.

Sector-specific tariffs or something even weaker, such as a threat of tariffs, would have USD sell-off by 3%+.

Energy

—

Crypto

I am waiting for the resolution in the bond and equity markets before considering any crypto positions.

China

Stimulus is becoming more likely as we get closer to Trump’s inauguration. I believe that the Chinese administration is waiting for the announcement of the tariffs and will want to see the CNY sell-off before unleashing their bazooka.

I keep FXI and KWEB on my watchlist.

Other

Last week was fun to watch NVDA, especially its CES 2025 Keynote. Physical AI is quickly becoming a reality and I am very excited about the future of AI. Having said that, the price action around the event showed a typical buy-the-rumor-sell-the-news behavior. The vertical line shows the last price before the keynote and the horizontal line shows ATH. The price dropped almost 12% following the event. Will we see the same leading up to NVDA earnings on Feb 26, 2025?

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.