Macro

Schrodinger’s soft landing macro framework is still intact, meaning that the market is constantly weighing the balance of risks between inflation and recession. So far, every single quarter since the beginning of 2024 the narrative changed.

Current consensus narrative:

No current worry in the market, except for uncertainty around Trump’s policy.

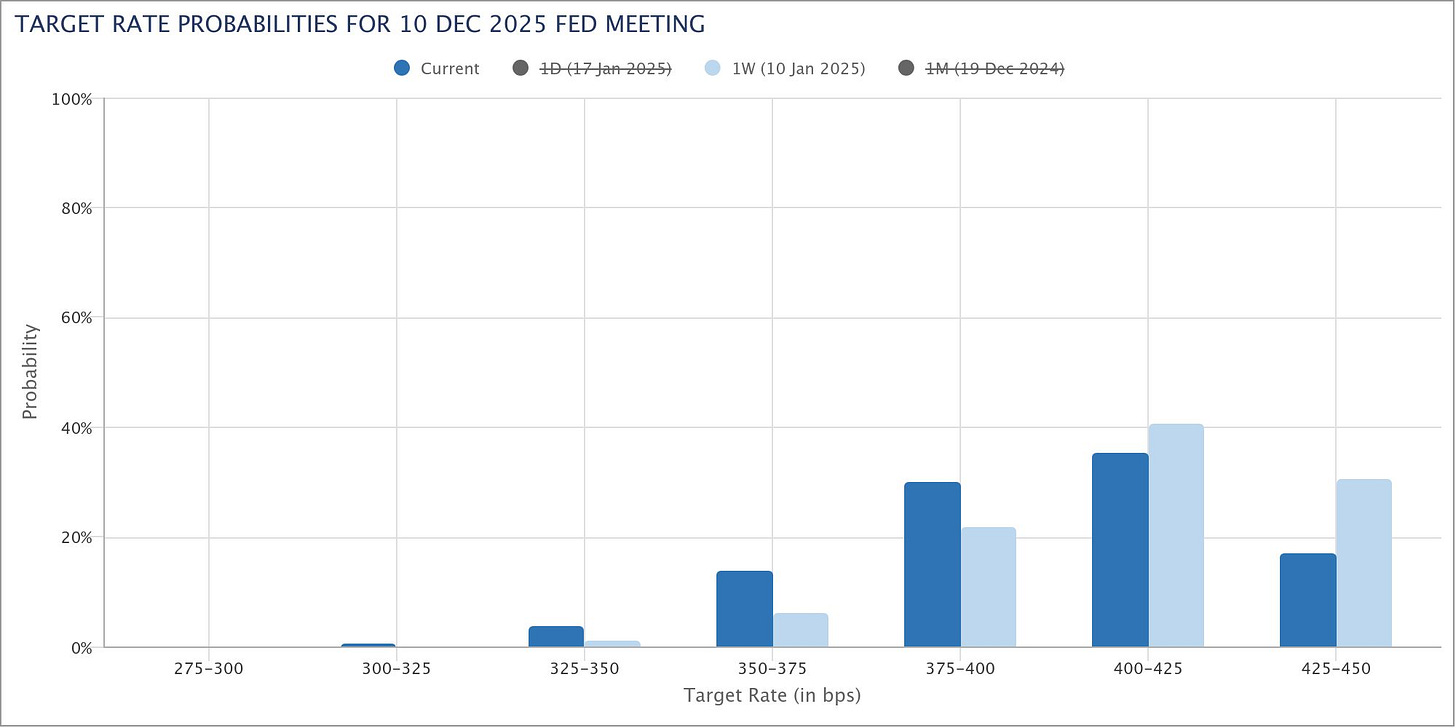

Rate cuts: repriced last week, the current consensus is that the Fed will skip and resume cuts after the next meeting, driven by low inflation prints and dovish Waller.

Growth/employment: no worries, no new data.

Inflation: cold prints last week relieved inflationary worries.

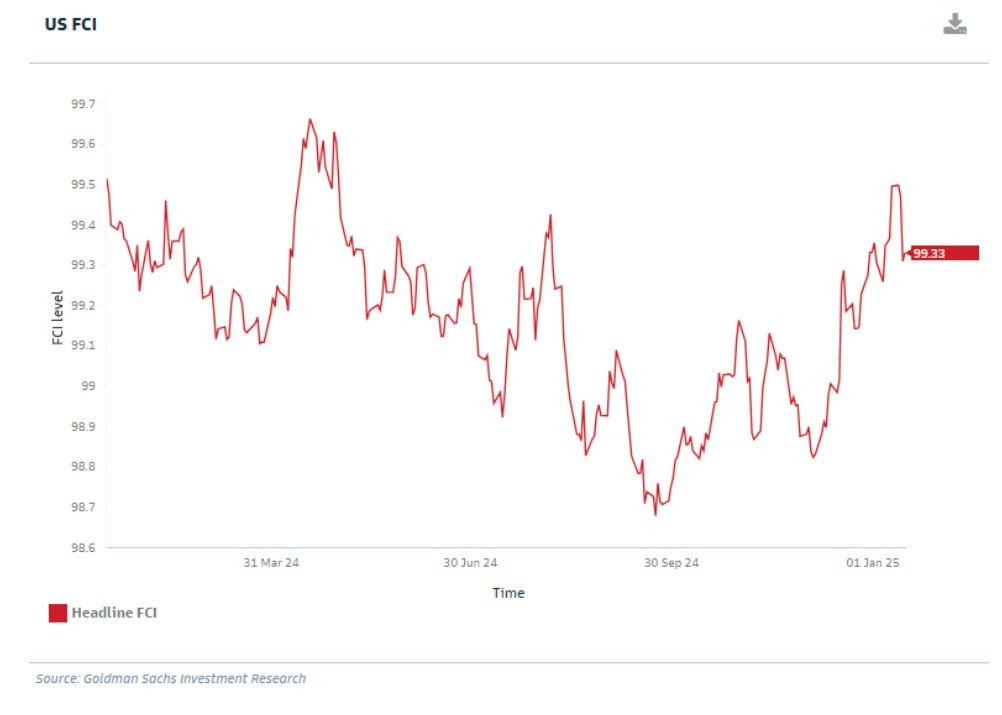

Financial conditions:

Credit spreads: no change, easy.

Yields: tightened, except for last week, but it seems to have no impact on housing demand, so it is hard to say how much of a tightening this really is.

Dollar: tightened.

Equities: eased, the last correction since December was very mild.

Energies: tightened.

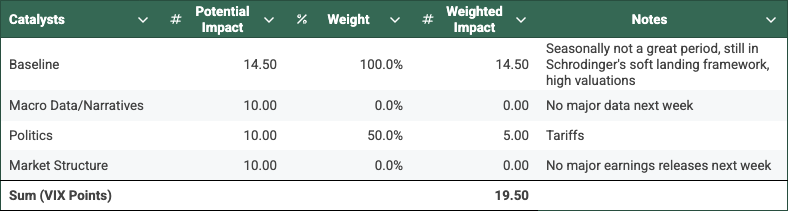

Potential catalysts next week:

Trump’s tariffs and policy announcements

No significant macro data

Politics

The market seems to be rather unconcerned about the prospect of hard tariffs. The playbook for next week is below:

TLT: hard tariffs = up (safe-haven rotation), easy tariffs = down (risk-on rotation).

USD: hard tariffs = up, easy tariffs = down.

VIX: hard tariffs = up, easy tariffs = down.

SPY: hard tariffs = down, easy tariffs = up.

TSLA: hard tariffs = potentially up (lower competition from Chinese auto manufacturers in the USA), easy tariffs = potentially down. Will be clouded by Trump’s other announcements around EV credits, etc.

FXI: hard tariffs = down, easy tariffs = up.

BTC: hard tariffs = down, easy tariffs = up. Will be clouded by Trump’s other announcements about crypto.

Oil: hard tariffs = down, easy tariffs = up.

Earnings

Bank earnings were good. Next week - Netflix.

Equities

Last week we saw almost a 4% gain in SPY. We filled the election gap, we completed three waves of selling, we witnessed a wedge breakout, and we observed a hammer candlestick marking a (potential) trough. The potential projected path serves to show that the trendline could act as a support. Otherwise, the longer-term channel would act as a support/resistance providing around -3.5% downside and around 8% upside.

In any case, the future path is contingent on the above-discussed policy announcements and macro drivers.

I aim to trade based on the tariffs announcement. Generally, I aim to increase my long exposure through SPY, QQQ, and a few select stocks, buying shares or LEAP calls.

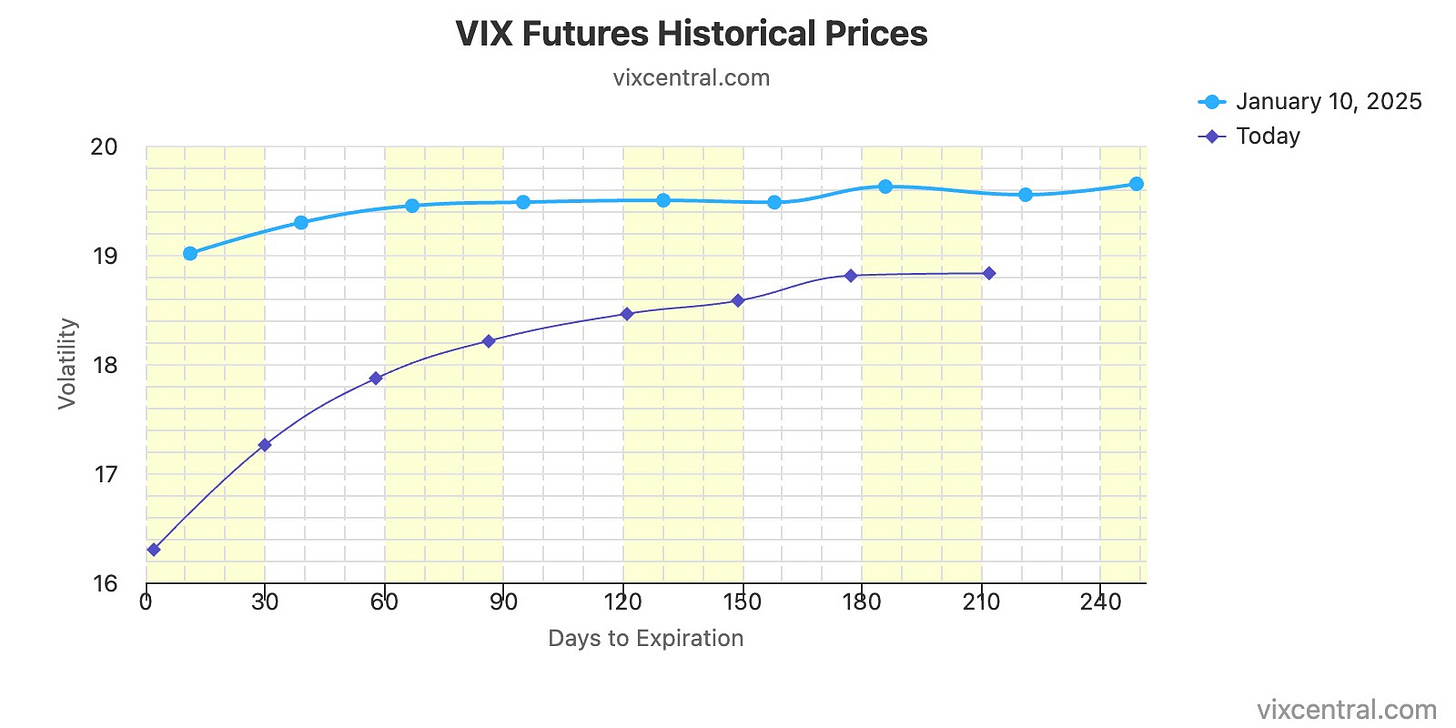

Volatility

Volatility receded last week with the relief around runaway inflation worries.

I adjusted my Risk Assessment tracker below.

My current estimate of the VIX fair value for next week is 19.5.

Once we get the tariff announcement, this risk will (quickly, or eventually) dissipate.

I maintain around 15% of my short-vol position.

Last week, I entered into a few VIX call debit spreads to hedge my exposure and benefit in a risk-off scenario.

I aim to trade based on the tariffs announcement.

Bonds

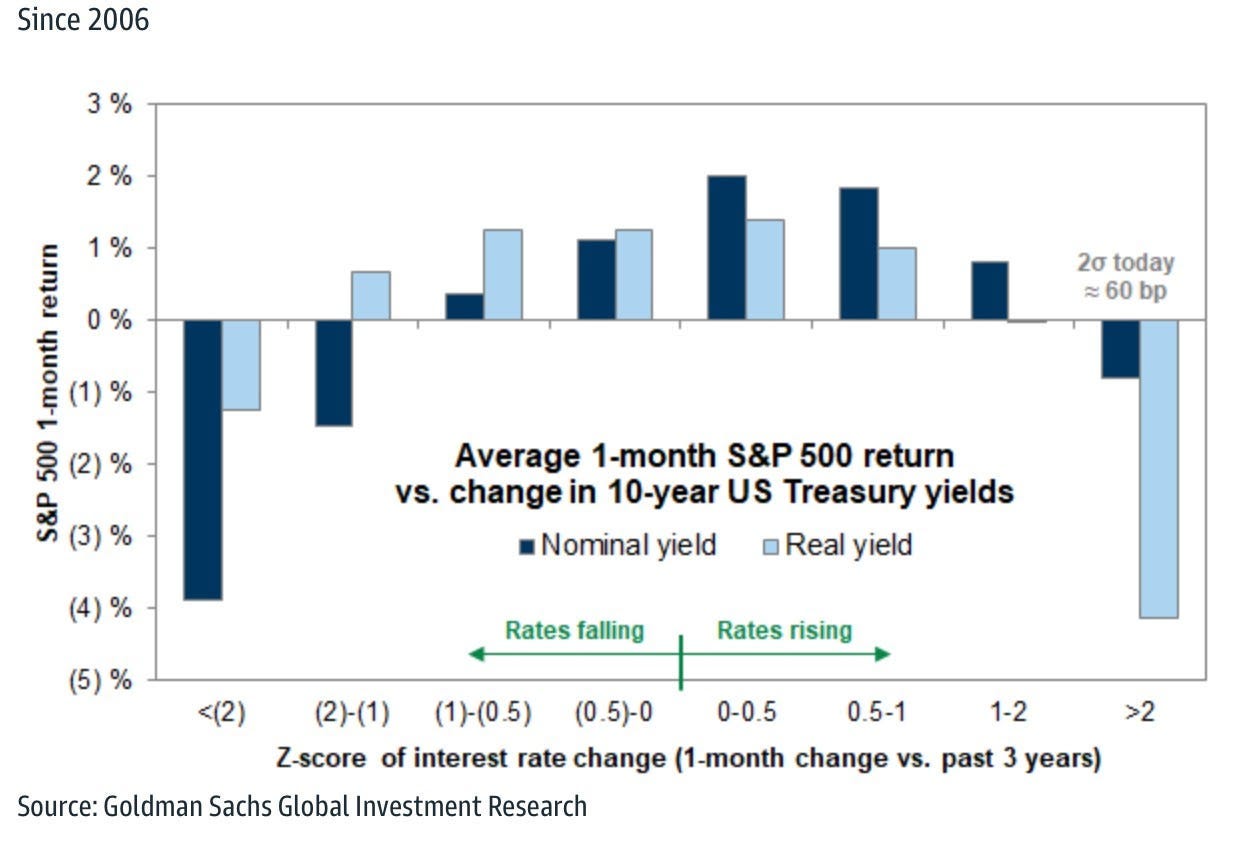

I found this chart interesting - equities react to sharp moves in bonds rather than to the level per se.

The 10Y yield dropped last week from 4.8% to 4.6%. Until the next Fed rates announcement (January 29), the 10Y yield will be dictated by policy announcements.

I have two call ratio spreads on TLT, betting on TLT somewhere between $90 and $100.

I aim to trade based on the tariffs announcement.

FX

Same dynamics as the bonds.

Energy

—

Crypto

Bitcoin defended $90k support. In a risk-on scenario (such as easy tariffs and generally bullish remarks by Trump), I can see Bitcoin forming new highs.

I aim to trade based on the tariffs announcement.

China

Similarly to crypto, in a risk-on scenario, China is primed to rally. There is a persistent negative stimulus around China (understandable, given the risks, especially around the Trump-Xi relationship). However, the potential to rally is great should the risks dissipate and the sentiment turn.

Key stats: up to 10% share reduction, 25% earnings growth, 50% re-rating. This has the potential to 2x.

Share reduction plus dividend less SBC:

Alibaba: 10.4%

JD: 10.1%

Tencent: 3.2%

Also, GMV in Q4 looks good and I believe China will be free to unleash more stimulus once they get clarity on the tariffs.

I aim to trade based on the tariffs announcement.

Other

—

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.