Recap of Last Week

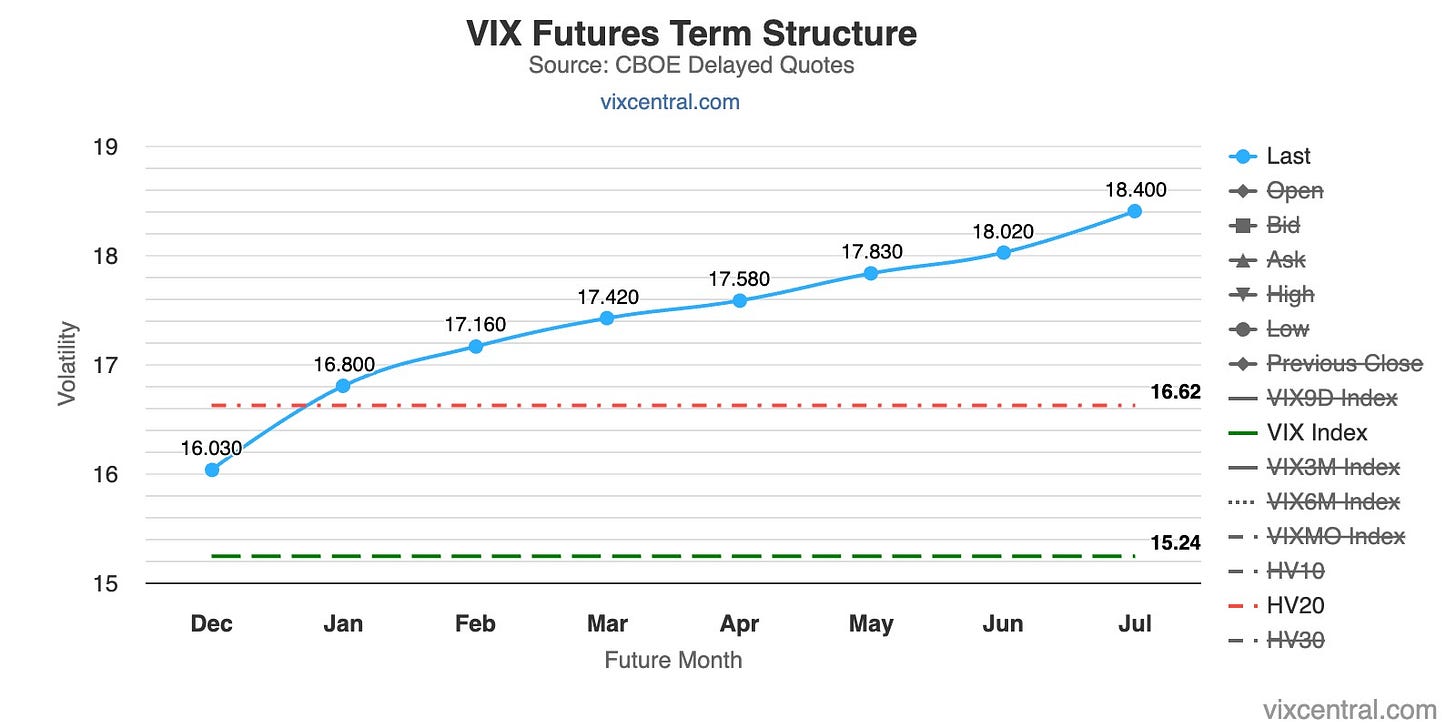

SPX was up by 1.68% last week, which confirmed the view from the previous week that the selling pressure of that week was highly mechanical and would reverse the following week. But it wasn’t all smooth sailing as the war in Ukraine escalated and drove a good share of volatility. VIX spiked to around 18.80 and closed at 15.24 (-5.58% weekly change).

Trump continued appointing people who are likely to deliver on his mandate of extinction-level event for the federal bureaucracy. Most importantly for financial markets, on Saturday Trump picked Scott Bessent as the US Treasury Secretary. Markets will like this as he represents the voice of reason and supports tax cuts, lower spending, phased-in, gradual, targeted tariffs, lower deficits, and lower inflation. In simple terms, he supports a 3-3-3 policy (cut the budget deficit to 3%, target 3% GDP growth, and increase US production by 3 million barrels of oil equivalent per day).

Bitcoin surged to almost $100k, NVIDIA reported earnings beating estimates, PMI in Europe came in very low and the EUR dropped below support levels.

Preparation for the Upcoming Week

Macro: Another quiet week ahead. Preliminary GDP, unemployment claims, and FOMC minutes on Wednesday. Thanksgiving on Thursday.

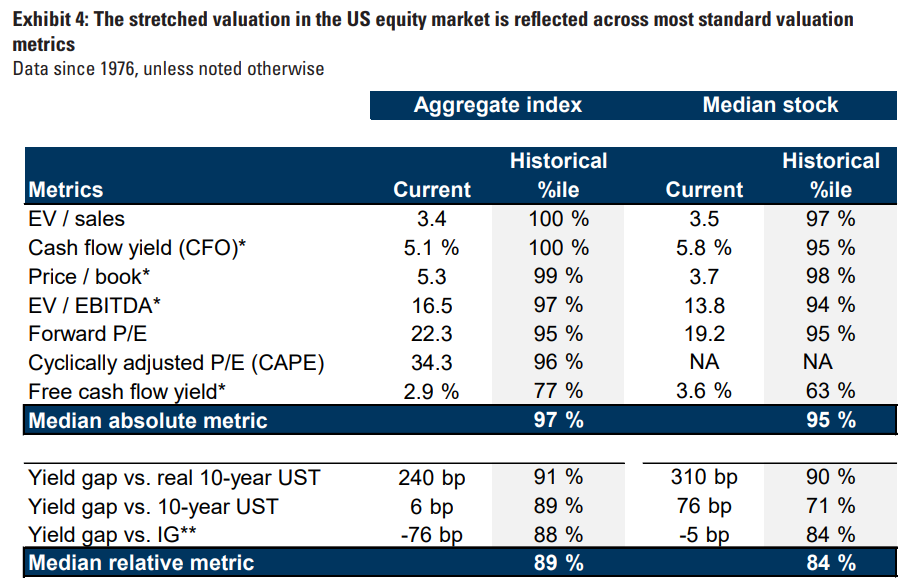

Equities: I am hearing a lot of concerned voices pointing at the stretched valuation of US equities, as it reached 97th percentile in aggregate. Interestingly, the one metric that is not that stretched is FCF yield. This can be explained either by an overall improvement in working capital efficiency or by depreciation overstating CapEx (or perhaps due to high stock-based compensation?). This discrepancy suggests that there may be some valuation cushion, as, in the end, cash is king. Anyways, the risk/reward for entering new long positions is not great and the market will be extra sensitive to any risks of earnings slowdown. We would need earnings to grow 10% and prices to drop 10% to make valuations more appealing. However, I don’t see the current situation as a signal to sell. Financial conditions are very easy, consistent with the global synchronous cutting cycle, which is very conducive to earnings growth.

I remain invested but I am not increasing exposure to broad-based indices until valuations become more attractive.

Last week I sold puts on ES, capturing elevated volatility. I don’t plan to sell more puts this week unless we get VIX above 18.

Volatility: I see the fair value of VIX in the range of 14.5 - 15.5. Seasonality and the holidays ahead suggest VIX of 12. I add 2 points as the stretched valuation in the US equities may spook the markets. I add 0.5 - 1.5 points for the risk that the war in Ukraine escalates, or that the Ukrainian front collapses before Trump’s inauguration.

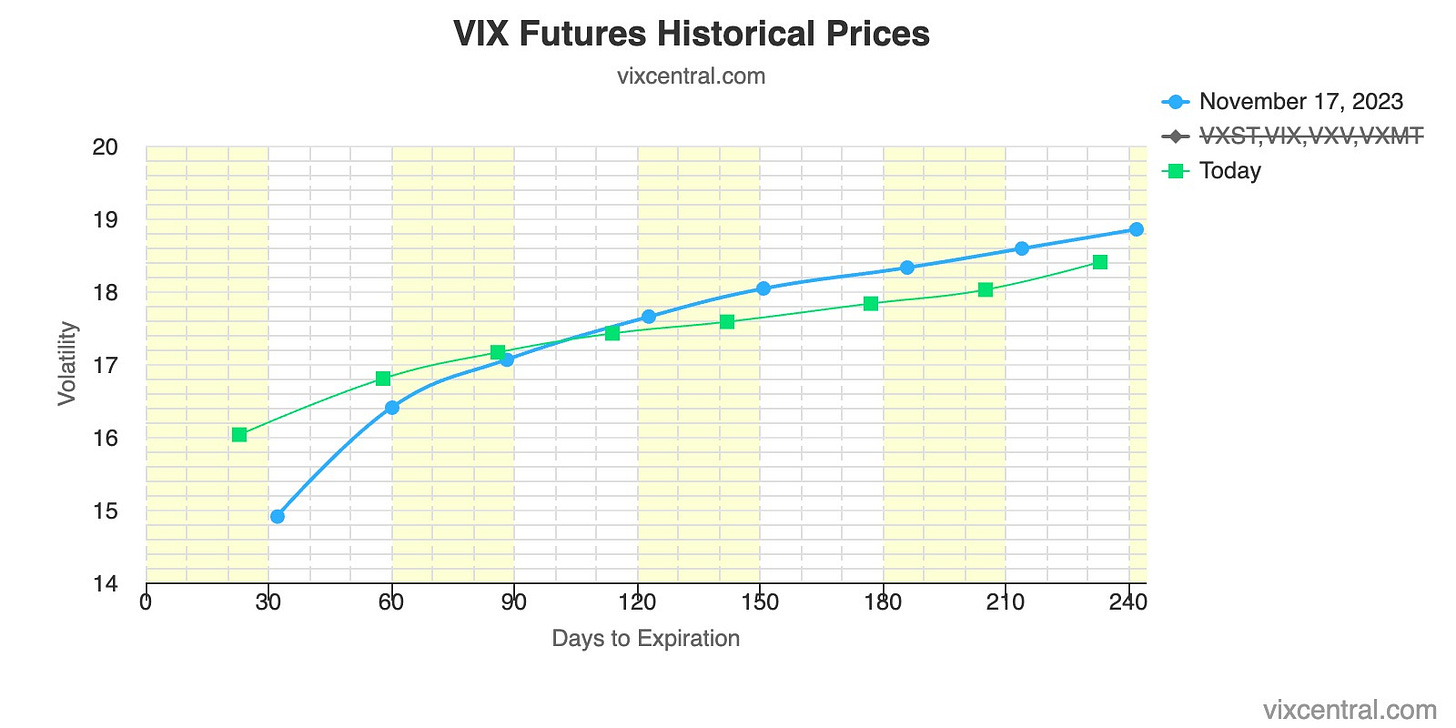

Both the futures and term curves look normal. Interestingly, the spread between December and January contracts is only 0.8, about half of what it was last year before Thanksgiving. Realized volatility is relatively high at 16.62.

Futures are above my fair value estimate. I remain short UVXY and long SVIX.

I will increase my long-vol hedge once VIX dips below 14.

I will sell ATM straddle on VXX or UVXY to test out a new strategy.

I may bet on the Dec/Jan spread to widen.

Bonds: The appointment of Bessent will be bullish bonds in the short term, and the 10-year yield could drop next week (to 4.25%?). This would be positive for equities.

I exited my TLT position as I realized that the risk profile of that position was very similar to my other positions in my portfolio. Instead, last week I bought SVOL, which has a decent exposure to bonds.

Energy: I am working on uranium primer. I am also planning to look at oil services.

I remain invested in URA and U.UN.

I am watching NESTE.

Crypto: Everyone is eying $100k Bitcoin. I am not sure if this will on balance trigger more selling or buying. But I am broadly optimistic about the future of Bitcoin.

I will trim some of my speculative crypto positions and keep only the long-term positions.

Other:

Cluseau had a great post on CBL - I am buying.

Google dropped by ~5% this week on the back of the news that they will be required to divest Chrome. This is an obviously bad deal for Google (and the consumer) and I believe a misguided act by the regulator. I will keep my position and expect Google to defend itself ferociously in court.

I remain short DJT.

I am watching FXI and BABA for re-entry.

I am considering buying WPS.

Disclaimer: This content is provided for informational purposes only and does not constitute professional advice. Readers acknowledge that the material is general in nature, creates no advisor-client relationship, and should not be relied upon without independent professional consultation. The author and Litus Research Substack exclude liability to the fullest extent permitted by law for any damages or losses arising from the use of this information. By accessing this content, readers agree that any reliance is at their own risk and waive claims against the author. All rights reserved.